I’ve never seen state government in such good financial shape when the Legislature is needing to adopt a new two-year budget. The Senate and House shouldn’t have any problem coming up with a no-new-taxes budget that is good for mental-health services, and special-education services, which seem to be at the top of the list of bipartisan priorities this year.

Instead of seizing a golden opportunity to keep tax rates stable, which can only help keep Washington’s economy humming along, the Senate’s majority Democrats have trotted out one needless tax bill after another. But now the first policy and fiscal cutoffs are behind us. There are far fewer bills competing for the attention of the public, and the news media. It’s time to raise the alarm, so the hardworking taxpayers of our state can know what the majority is up to.

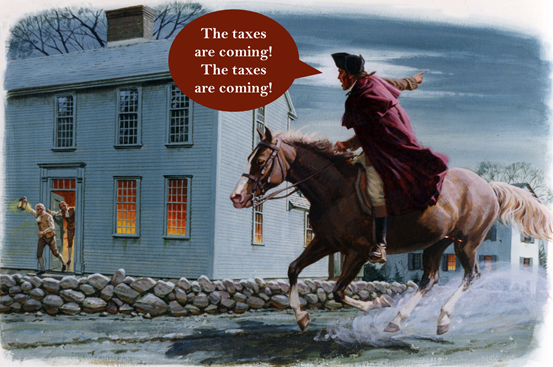

Because the taxes are coming.

I’ve been through a session similar to this – positive revenue picture, full Democrat control of the lawmaking process, and a governor (Mike Lowry) who was swinging for the fences when it came to tax proposals. It was my first session, in 1993.

I recently saw a list of the taxes that were raised that year, and it was even longer than I remembered. Sales taxes were extended to certain personal services, the B&O tax went up 67% on certain services, the real estate excise tax was expanded, and more.

It was also the first of the times I’ve seen a Democrat-controlled Legislature go into overtime because the two chambers couldn’t agree on which taxes to raise, and by how much.

The Democrat “Taxapalooza” going on this year could be far worse for families and employers. Instead of a sales-tax hike, the majority is positioned to pursue the state’s first income tax. As in 1993, there’s a 67% B&O hike – which will increase taxes on service providers like veterinarians and janitors and be passed on to consumers. There is also, again, a higher REET on the table– which will drive up the cost of apartment rents and add to our housing-affordability crises.

Governor Inslee’s electricity mandate, passed by the Senate on Friday, is functionally a tax that could raise utility bills as much as $35 per month. There’s a bill on fuel standards that would amount to a 16-cent tax hike on a gallon of fuel, and the carbon tax/gas tax/property tax/auto-parts tax combo in SB 5971. There’s even a woodstove fee increase, and no one should forget the plastic-bag ban bill – also a tax in everything but name.

It doesn’t have to be this way. But the taxes are coming.