Repeal the capital gains income tax

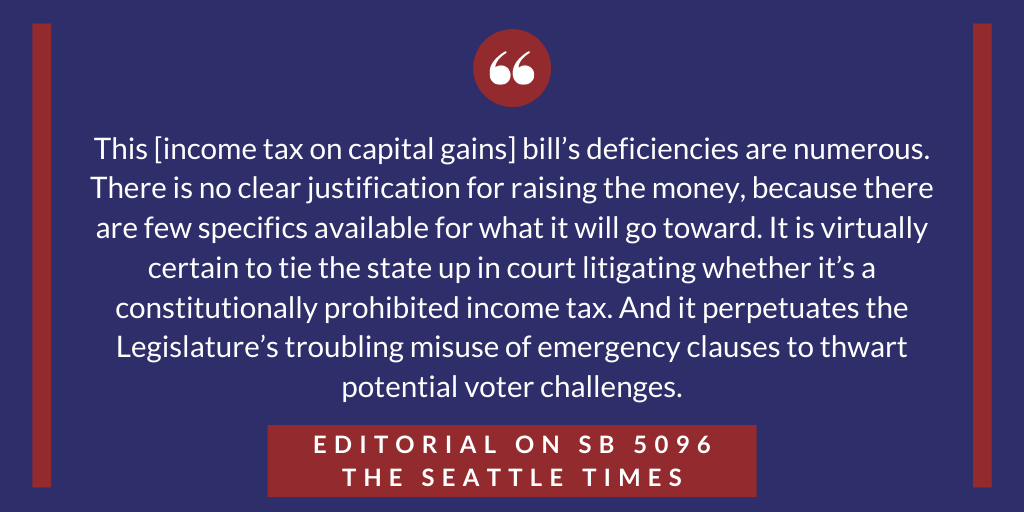

In 2021, Democrats passed an income tax on capital gains. They argued it was actually an excise tax, not a graduated income tax, and was, therefore, constitutional.

Washington Policy Center did extensive outreach to the 49 other states and the Internal Revenue Service, all of which said a capital gains tax is an income tax. And, since it only applies to certain people who earn a higher level of income from such things as the sale of stocks, it is a graduated income tax. This means it is illegal, according to the Washington State Constitution.

However, the liberal Washington State Supreme Court upheld the tax as an excise tax and the United States Supreme Court declined to hear the appeal. The income tax on capital gains stands.

I-2109 would repeal the tax, which is overwhelmingly unpopular with the people.

Democrats are fighting hard against this initiative, however. Fuse Washington, a progressive political group, claims I-2109 would “steal billions of dollars in funding from early learning and education to give a tax cut to Washington’s wealthiest to 0.2%.”

In fact, in emails uncovered through a public-records request by the Washington Policy Center, legislative Democrat leaders have stated clearly that their capital-gains tax is just the first step toward a full-blown, statewide income tax.

Before the ink was even dry on the capital-gains tax bill, Democrats were slipping into the budget an expansion of the tax — just as we predicted they would. When Democrats do expand the tax, it will target small business owners, family farms, entrepreneurs, and restaurant owners.

For now, Republicans pushed for I-2109 and the other five certified initiatives to the Legislature to receive public hearings. This is in line with the state constitution, which clearly states initiatives are to take precedence over all other legislation except budget-related bills.

The majority held hearings on three initiatives, but refused to hear I-2109, I-2117 and I-2124. Instead, they chose to spread misinformation and fear about the impact of repealing the income tax on capital gains and the cap-and-tax program in the “Climate Commitment Act.”

These three initiatives will go to the a vote of the people in November.

Using children as an excuse for the income tax on capital gains

Initiative 2109 will force legislators to prioritize; K-12 will not be hurt

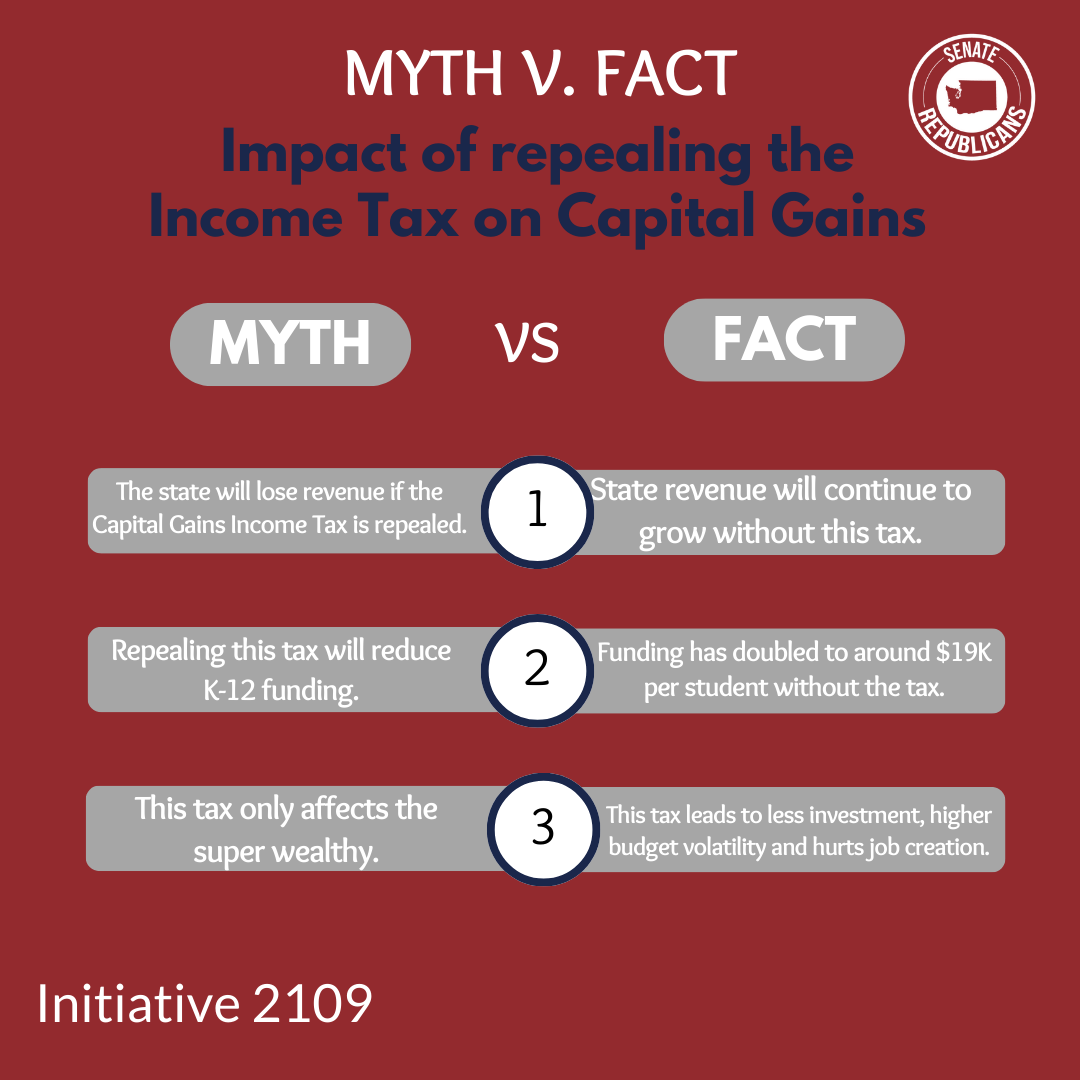

The income tax on capital gains doesn’t pay for anything that can’t be funded with other revenue.

- This only involves $1 billion per year from a biennial budget of $70 billion.

- K-12 funding is going to be provided no matter what, precisely because it is “paramount duty.”

- Using children as a defense for an unnecessary, unpopular tax is a classic, and unnecessary, scare tactic.

K-12 funding should never be linked to a volatile source of revenue

Revenue from capital gains is not reliable enough to support essential services.

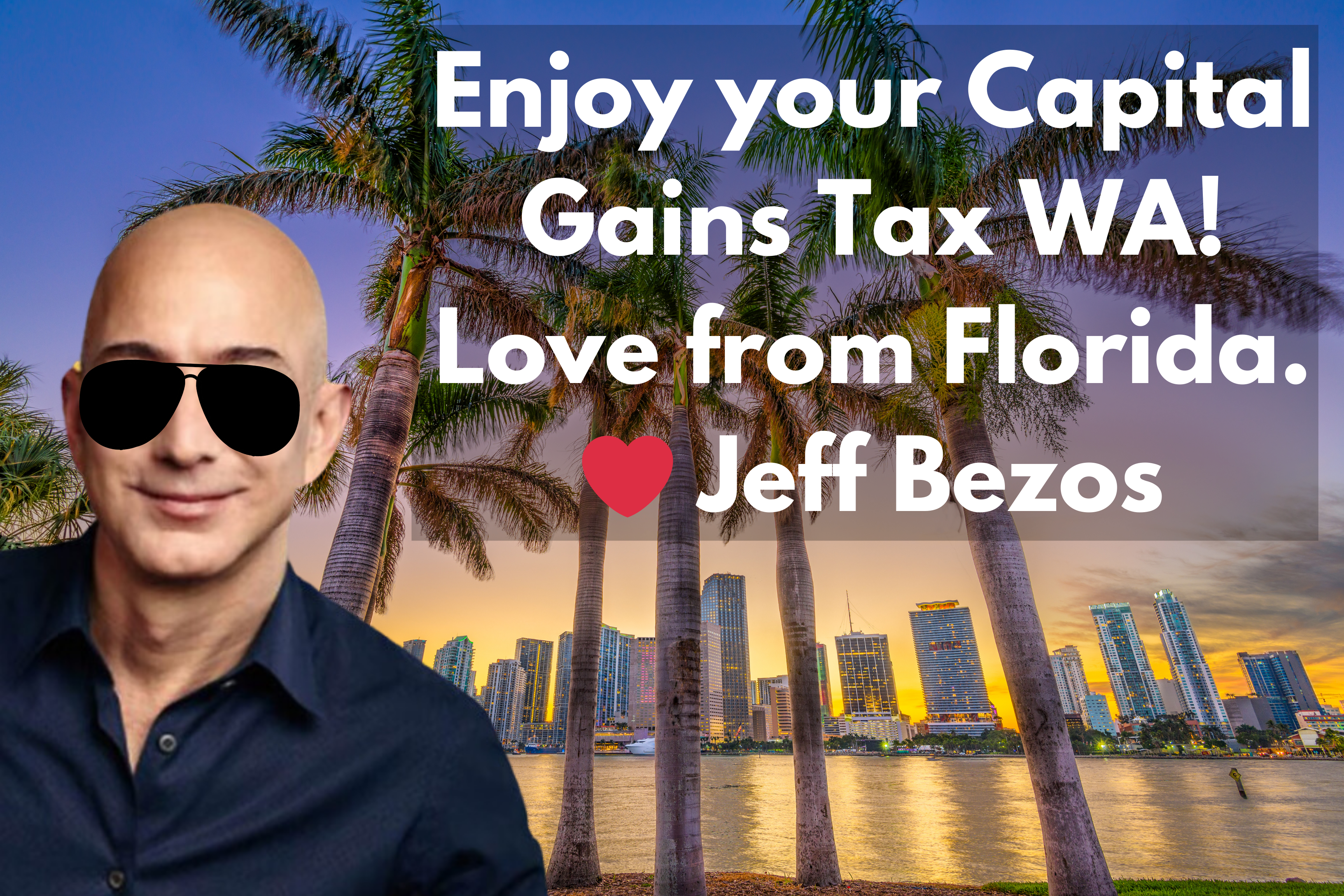

- Washington will will miss out on $750 million in revenue from the income tax on capital gains ($140 million recently and $610 million before year’s end) simply because Jeff Bezos moved to Florida (news report here). 56% of the capital-gains revenue collected in year one came from a total of 10 people, all of who could easily leave Washington just as Jeff Bezos did.

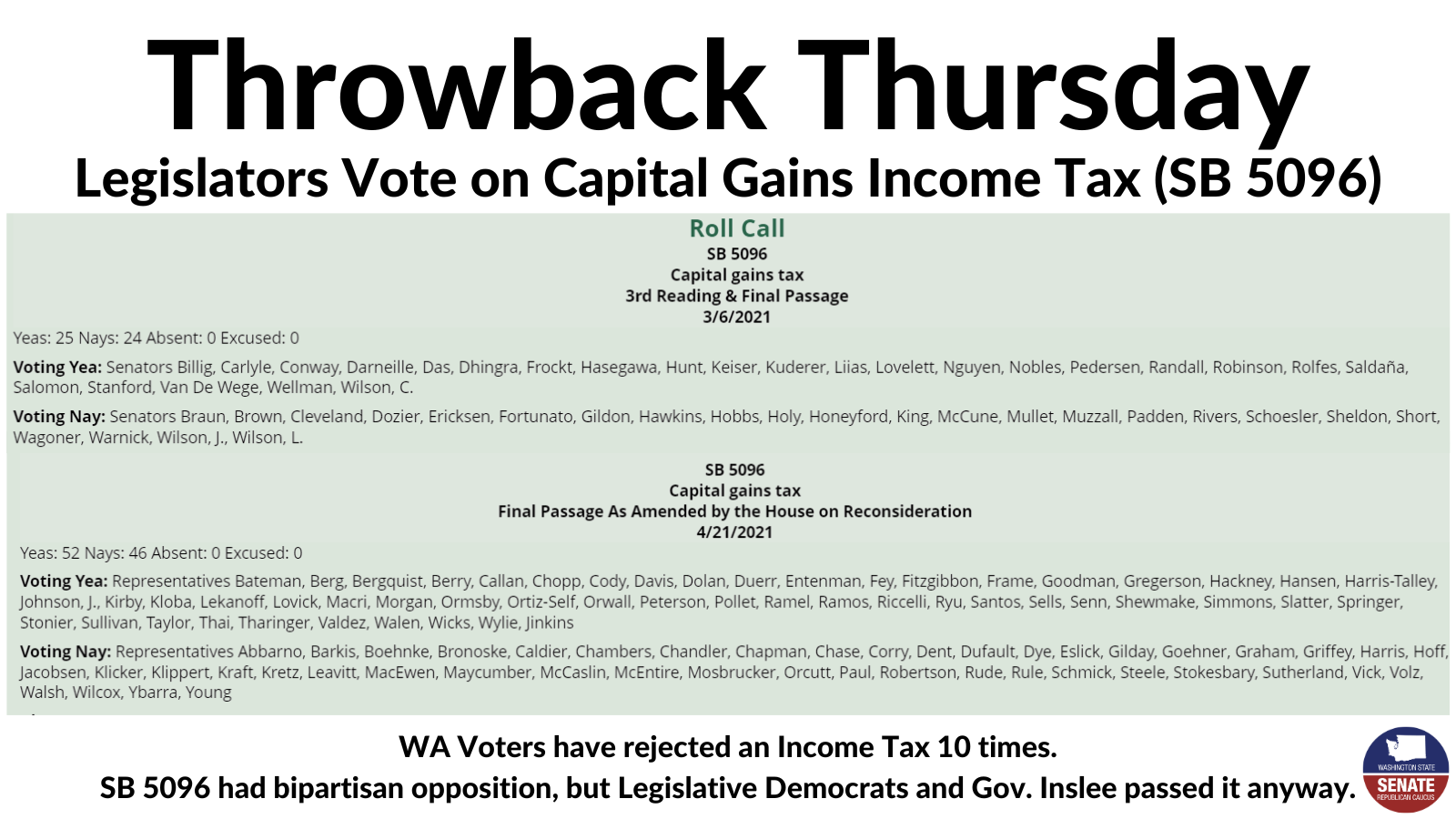

- Connecting K-12 to the income tax on capital gains conferred false legitimacy on an opportunistic bill — the two should never have been tied together. The income tax on capital gains tax was introduced every year since 2010. Passage in 2021 came only after the Senate majority had 25 members who would support the bill.

Look for supporters to cry ‘tax-the-rich’ and ‘regressive tax code’

- If the majority wants more revenue, it could change the eligibility threshold and define more taxpayers as “rich” for purposes of taxation; approval of I-2109 would prevent that.

- If the majority wanted to make Washington’s tax code less regressive it could have coupled the income tax on capital gains with a sales-tax reduction or some other reduction to a regressive tax… but did not. Instead, they simply added the income tax on capital gains tax… a money grab driven by government greed.

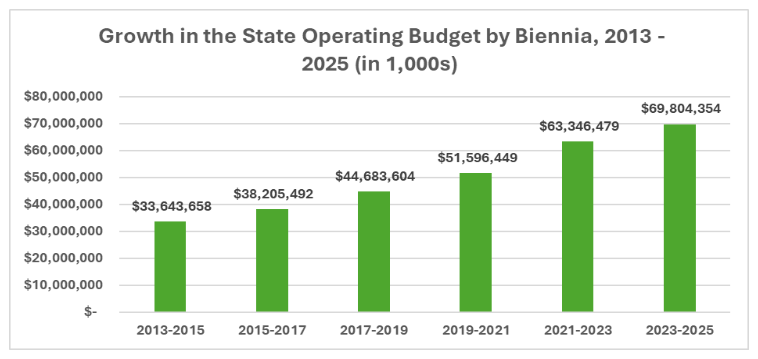

The Legislature has a spending problem, not a revenue problem

Growth in State Spending

ARTICLE: State revenue has grown rapidly. Legislative Democrats falsely claim Initiative 2109 will “result in the loss of the money.” “It comes across as arrogant and greedy to bemoan the ‘loss’ of money the state has never received.”

Listen

I-2109 is Path to Public Vote on Income Tax

Quotable

“Some of the hot takes from national tax experts on Washington’s court discovering a new way to tax capital gains income have been very interesting. Here are some of the comments from a tweet thread by the Vice President of State Projects at the Tax Foundation:

- “You don’t have to dig deeply into the Washington supreme court’s decision in the capital gains tax case to find egregious errors. There’s an obvious, and crucial, falsehood in the second paragraph.”

- “The justices spend a dozen pages outlining how they think the prior tax code is unfair, citing wildly inaccurate studies along the way. What’s missing from the decision is any credible basis for believing the tax is constitutional.”

- “The state supreme court acknowledges that income taxes are unconstitutional, says this is distinguishable because it’s somehow an excise tax, and tries to prove it by claiming that income taxes *are* excises taxes. They’re contradicting each other from one page to the next.”

- “This case is incredibly simple. This dissent says everything that needs to be stated.”

- “I try to be respectful of court rulings, and recognize that state supreme court justices know much more about the law than I do, but I don’t see any way to get around it on this one: the court wanted a capital gains tax so it ruled in favor even though the argument was ludicrous.”

Our state Supreme Court has ruled and the issue is “settled” now in Washington unless there is a federal challenge for violating the commerce clause or the voters respond with a ballot measure. With respect to the tax expertise of our state justices, I’ll still stand with the rest of the planet in the clear understanding that excise taxes aren’t applied to income – those are called income taxes.”

Read the entire article “Washington versus the world on capital gains income taxes”