Ban an income tax in Washington

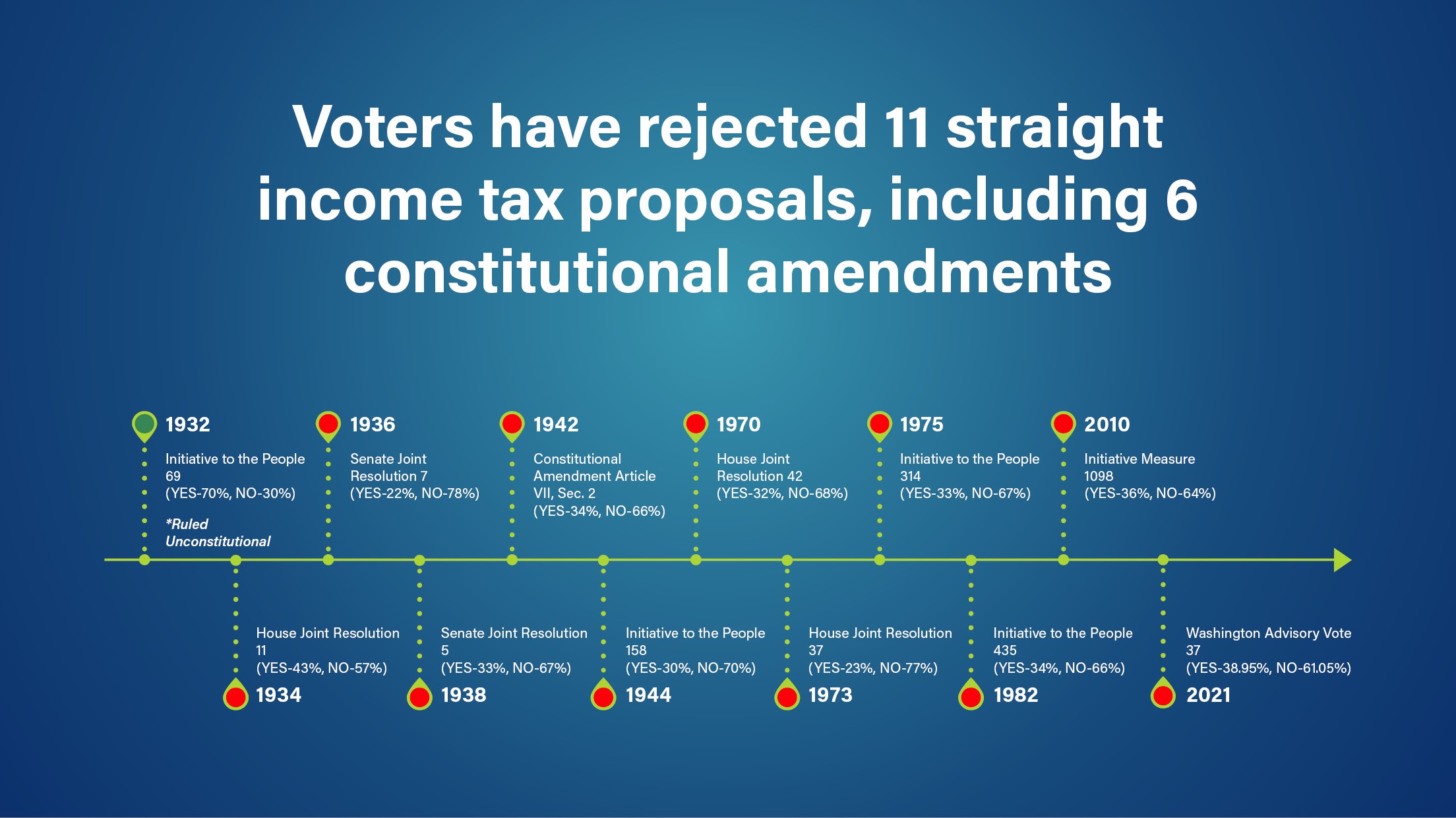

Voters have rejected an income tax 11 times

Initiative 2111 bans the adoption of a personal income tax in Washington at all levels of government. The people of Washington have overwhelmingly rejected an income tax 11 times. Yet, majority Democrats ignore the people and continue to push for an income tax, including an amendment to the Washington State Constitution, which does not allow a graduated income tax.

They see small victories, such as their income tax on capital gains, as a path toward a statewide income tax like Oregon has, but without eliminating or reducing any other taxes to compensate.

Our Constitution says that addressing initiatives to the Legislature is the top priority, second only to bills necessary to write the state budget. This means it is the Legislature’s constitutional duty to give I-2111 and the other initiatives a hearing. Fortunately, the people were able to weigh in on this initiative during a joint hearing in the Senate and House finance committees.

And on March 4, 2024, I-2111 passed in the Legislature. It will become law 90 days from the March 7 adjournment of the Legislature.

Watch senator comments in committee

I-2111 was voted out of the Senate Ways & Means Committee on March 1, 2024. Republican Senators Lynda Wilson and Keith Wagoner spoke in support of the initiative.

Initiative 2111 received a hearing on Tuesday, Feb. 27 during a joint meeting of the Senate and House finance committees. Of the 7,265 people who signed in for the hearing, 89% of them signed in PRO.

Key points PRO:

- This initiative does not harm any existing revenue or programs.

- Opponents claim it’s a “do nothing” bill, but it does something — it protects us from a state or local income tax.

- While some argued that it is a waste of legislators’ time to hear the initiative, the truth is that it is a constitutional priority to address the initiatives and giving the people a chance to be heard is never a waste of time.

- Washingtonians have rejected an income tax 11 times. More than 6,000 people signed in to support the initiative. This is what the people want. Listen to the people.

- Washington does not have one of the most regressive tax structures. That is a talking point from a liberal tax organization dedicated to pushing for an income tax.

Watch citizen testimony

Watch additional testimony:

Victory on I-2111!

I-2111 passed in the Senate 38-11. It passed in the House 76-21. Since Democrats have a clear majority in both chambers, this vote shows that I-2111 had strong bipartisan support. Washingtonians do NOT want an income tax. We hope this vote shows that some Democrats are listening to the people.

Watch Sen. Lynda Wilson’s floor speech on final passage of I-2111

Quotable

Senate Republican Leader John Braun, R-Centralia, says there’s still time to give the remaining three initiatives a hearing. Read the full statement.

“Some opponents of the initiatives have testified that the Legislature has better things to do than hold these hearings. I couldn’t disagree more – upholding our state constitution should never be characterized as a waste of time. It’s been a tough fight to get Democrats to perform their constitutional duty by prioritizing the initiatives over everything except bills that involve appropriations, but I see no reason why the majority can’t find three more hours in the next week to listen to the people on the three remaining measures. The fight isn’t over. We’ll continue to call upon them to do the right thing and listen to the people.”

Learn more about I-2111

I-2109 and I-2111: End Income Taxes in Washington

Listen

Sen. John Braun talks to Lars Larson about initiatives to the Legislature that fight income taxes and repeal the income tax on capital gains

Quotable

Our state has an affordability crisis. The last thing Washingtonians need is a new income tax. The people of our state have also rejected an income tax at the ballot box 11 times. Honor the will of voters. Listen to the people. This initiative is popular, provides clear assurances for the future, and is good for individuals and families. Republicans fully support it. Our state constitution states that initiatives should be a top priority, higher than anything else but the budget. Majority Democrats should give this initiative, and all others before the Legislature this year, a hearing. It’s our constitutional duty.

Six Myths About the Income Tax

Myth 1

“It would make our tax system ‘more fair.'”

- Our system isn’t unfair.

- It gets a bad rap because of high excise taxes on gasoline, beer, wine, liquor and marijuana, which Democrats don’t want to cut.

- Legislative Democrats advocate measures that would slam the poor with higher gas and electricity prices.

- The argument that Washington’s tax system is the “most regressive” is based on an assessment published by a very progressive tax organization, which many people accept that without question.

Myth 2

“It would only hurt the rich.”

- Tax advocates say an income tax would only hurt the rich, which is not true.

- Once implemented, an income tax would grow to include all income levels.

- It’s also a highly volatile tax. The “rich” will move to one of the other states to avoid the tax, taking their taxable income, and often the jobs they provide, with them.

- It’s also volatile in a recession. We can’t count on the revenue, which means programs that depend on the money could be underwater later.

Myth 3

“It would result in a reduction in other taxes.”

- Proponents of the income tax let people believe that other taxes would be reduced or eliminated if Washington implemented an income tax. This is not true.

- An income tax would just add to the mountain of taxes in Washington, not replace any.

- Look at the capital gains income tax passed in 2021. The revenue from that did not translate into the lowering or elimination of other taxes.

Myth 4

“The state needs the money.”

- For a few years now, Washington has had an extraordinary amount of revenue above and beyond projections.

- There is never going to be enough money for to do everything everyone wants.

- Tax collections skyrocketed $20 billion between 2013 and 2020, enough to cover every need.

- Since 2021, projections of future tax collections have increased more than $7 billion, not counting the revenue from the income tax on capital gains.

- Don’t accept government greed.

Myth 5

“Income taxes do not drive away business and industry.”

- This argument requires us to suspend belief in basic economic principles and ignore that Amazon already has one foot out the door.

- Its founder, Jeff Bezos, has already moved to Florida to avoid the income tax on capital gains, taking more than $1 billion in annual revenue with him.

- The state Dept. of Commerce used the absence of an income tax as a big point in its business-recruitment ads, dropping the claim when Democrats started pushing for an income tax on capital gains.

Myth 6

“Only Republicans oppose an income tax.”

- Of all the claims in this debate, this one was the silliest.

- The more than 400,000 people who signed each initiative were comprised of more than 50% Democratic and Independent on each one. Significant numbers of Republicans and Libertarians also signed.

- People of all ideologies and from all walks of life oppose an income tax here in Washington.

In the News

Progressive Income Taxes Don't Reduce Income Inequality

Excerpt:

“Illinois Gov. J.B. Pritzker claims one of his core motivations for scrapping Illinois’ constitutionally protected flat income tax – aside from raising $13-$18 billion to pay for campaign promises – is to reduce income inequality. Unfortunately for Pritzker, states with progressive income taxes have higher income inequality and have failed to slow the rise in inequality.

“Before the Great Recession, states with progressive income taxes had higher income inequality, measured by the Gini coefficient, than states with flat or no income tax. A decade later, not only do states with progressive income taxes still face higher income inequality, but the difference in income inequality between them and states without progressive income taxes remains the same.

“In other words, the progressive income tax has had no effect at combatting income inequality. That probably explains why the academic literature remains divided as to whether progressive income taxes have any effect on income inequality…”