Allow people to opt out of the “long-term care” payroll tax

All updates to this webpage will cease at midnight on March 7. No further updates will occur until after the election in November.

House Democrats pushed the passage of a bill to create the “WA Cares” program, which they claim is a long-term care benefit to assist people with the expenses of staying in a nursing home or other facility. However, the benefit is minimal compared to the cost of care and the payroll tax to pay for it is mandatory, whether you end up using the benefit or not.

Initially, people could opt out if they purchased a private long-term care plan, but providers quickly backed out of selling plans in Washington because someone could buy a plan and then cancel it as soon as they received the exemption.

The program has other critical flaws as well. If you pay into it for years, but retire in another state, you forfeit the benefit. It’s criteria also punishes moms who take a break from working outside the home to have and raise children. Younger adults who begin to pay into it now will have contributed far more into the program than the benefit

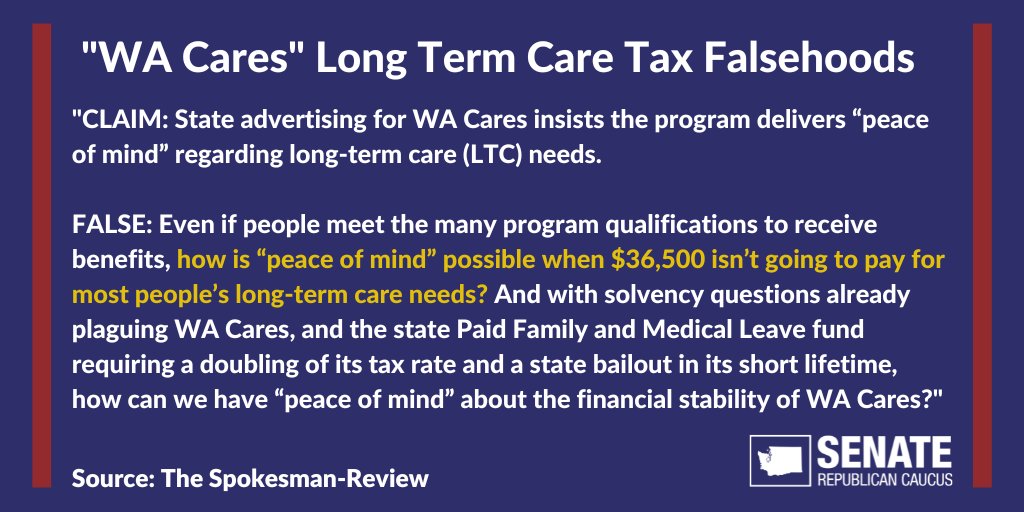

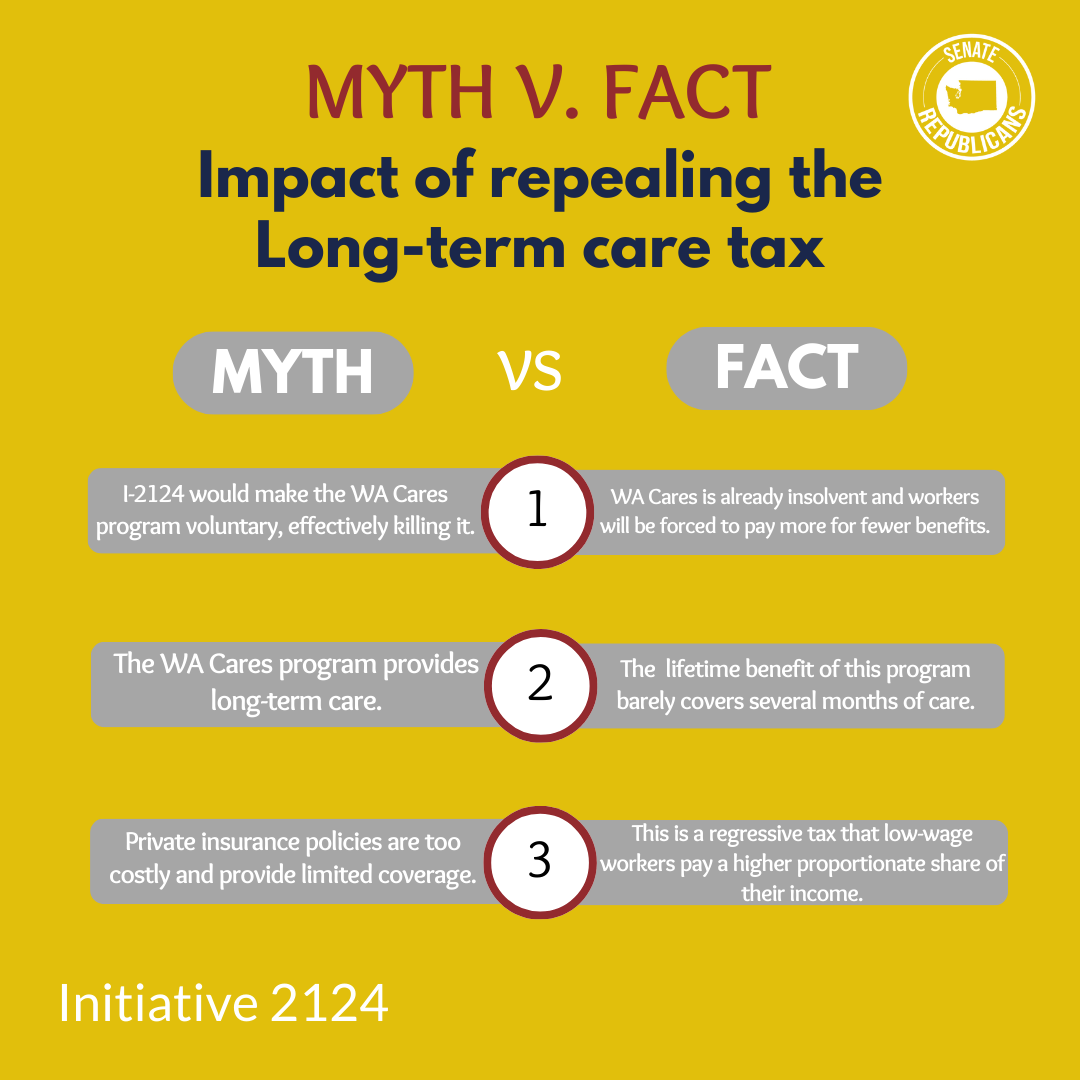

And, at the heart of it all, the program is not solvent.

Some want to repeal the program entirely, but I-2124 seeks to allow people to opt out — a right they should have had from its inception.

As with the other five initiatives, I-2124 deserves a hearing so legislators can listen to the concerns of the people. It is our constitutional and moral duty. If given the chance to vote on the initiative while it’s before the Legislature, Senate Republicans would support it.

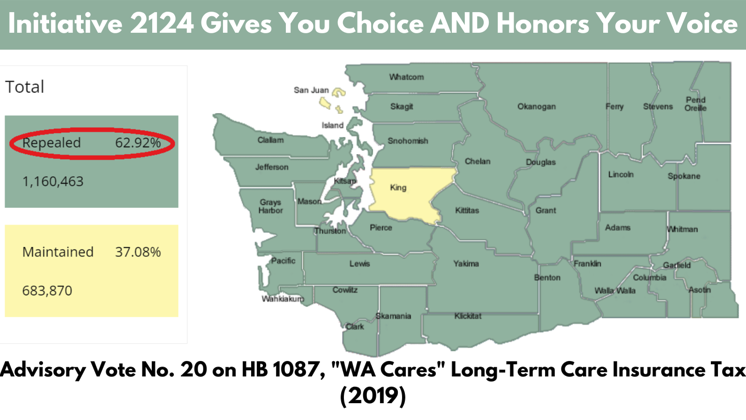

How unpopular is the "WA Cares" long-term care payroll tax?

A growing number of Democrats join Republicans in opposition. Voters reject it by 63%. Business & labor oppose the tax on most WA workers too. Initiative 2124 give workers the choice to opt out.

Watch

Why is this initiative necessary?

Initiative 2124 – Making the so-called “Long-Term Care” Payroll Tax voluntary was necessitated by the overwhelming Democrat vote for House Bill 1097 in 2019, which was signed into law by Gov. Jay Inslee.

(2019) HB 1087- Concerning long-term services and supports

Chamber: SENATE 2019 Regular Session

Motion: 3RD READING & FINAL PASSAGE AS AMENDED BY THE SENATE

Item No: 28

Transcript No: 93

Date: 04-16-2019

Yeas: 26 Nays: 22 Absent: 0 Excused: 1

| Voting yea: | Senators Billig, Carlyle, Cleveland, Conway, Darneille, Das, Dhingra, Frockt, Hasegawa, Hunt, Keiser, Kuderer, Liias, Lovelett, Nguyen, Palumbo, Pedersen, Randall, Rolfes, Saldaña, Salomon, Takko, Van De Wege, Warnick, Wellman, Wilson, C. |

| Voting nay: | Senators Bailey, Becker, Braun, Brown, Ericksen, Fortunato, Hawkins, Hobbs, Holy, Honeyford, King, Mullet, O`Ban, Padden, Rivers, Schoesler, Sheldon, Short, Wagoner, Walsh, Wilson, L., Zeiger |

| Excused: | Senator McCoy |

The Legislature has a spending problem, not a revenue problem

The "Long-Term Care" Tax, or "WA Cares" program, poses significant problems and drawbacks

- The limited benefits, high costs, regressive tax structure, insufficient coverage, lack of portability, limited opt-out options, unfair treatment of military members, and public opposition are all reasons why this program is considered a big-time disaster.

- These issues should be addressed by the Legislature to find better solutions for long-term care coverage.

- Limited Benefits

- High Costs

- Regressive Tax

- Insufficient Coverage

- Lack of Inflation Adjustment

- Lack of Portability

- Limited Opt-Out Options

- Unfair Treatment of Military Members

- Public Opposition

- Lack of Legislative Preparation

After paying into the program for 10 years (or three of the previous six years), enrollees are eligible for a maximum lifetime benefit of $36,500. This benefit can only be used if the enrollee stays in Washington, with no portability. This amount is significantly lower than the actual costs of long-term care, making the benefit negligible for employees.

The tax itself is expensive and burdensome for workers. The program is funded by a 0.58% payroll tax on Long-Term Care (LTC) earnings. Workers making $50,000 will pay approximately $288 annually, which may seem small, but for individuals living paycheck to paycheck, this tax can have a significant impact on their finances.

The WA Cares tax is regressive, meaning that low-wage workers will pay a higher proportionate share of their income compared to higher earners. This contradicts the claim by legislative Democrats that the state’s tax system needs to be reformed due to its regressiveness.

The program’s maximum lifetime benefit of $36,500 is far below the average cost of long-term care, which can reach up to $10,000 to $15,000 per month. The benefit amount provided by the program may not be enough to cover the actual costs, leaving individuals to make up the difference on their own.

While the benefit amount is expected to increase over time, there is no indication that it will keep pace with the rate of inflation. As a result, the benefit may become even less effective in covering long-term care costs as time goes on.

The program is not portable, meaning that if an individual moves out of Washington, they will receive no benefit from the program, even if they have been paying the tax for decades. This lack of portability is unfair to individuals who may need long-term care outside of the state.

The opt-out period for the program is limited and does not provide future opportunities for those under 18 years old or those moving into the state. This lack of opt-out provision forces these individuals to participate in the program, whether they want to or not.

The program does not provide an opt-out provision for Washington’s home-of-record military members who are currently serving outside the state but plan to return after leaving the service. This unfair treatment disregards the service of military members and their right to choose their own long-term care options.

Nearly 490,000 people filed for an exemption from the payroll tax during the initial opt-out period, indicating that many individuals do not want to participate in this program. The high number of exemptions requested highlights the need to address the program’s issues and consider alternative solutions.

The implementation of the Long-Term Care Act and the tax funding it lacked proper legislative preparation. The problems and concerns associated with the program should have been addressed before workers began experiencing deductions from their paychecks.

Listen

The "long-term care" payroll tax with Sen. John Braun

Editorial

Excerpt:

Aside from being a mandate that the majority of the people of Washington didn’t ask for, the plan, known as WA Cares, had other problems.

The Seattle Times editorial board opposed the bill as originally passed. The bill was a rush job and lawmakers agreed to delay the start of the program a year to fix problems. Yet, lawmakers ignored this responsibility even as its implementation date neared. Workers started paying the tax last year.

Now the Legislature is forced to make a choice. Initiative 2124 may appear on the November ballot, proposing to amend the law to make participation voluntary. Lawmakers can adopt the initiative, let it go to the ballot as is or propose an alternative that would also appear on the ballot.