Increase in the Property Tax Growth Rate

Watch

UPDATE: SB 5770 won’t get a vote this year

What the Bill Does

- SB 5770 would TRIPLE the growth rate of annual property tax collections for governments in Washington – raising the cap from 1% to 3%.

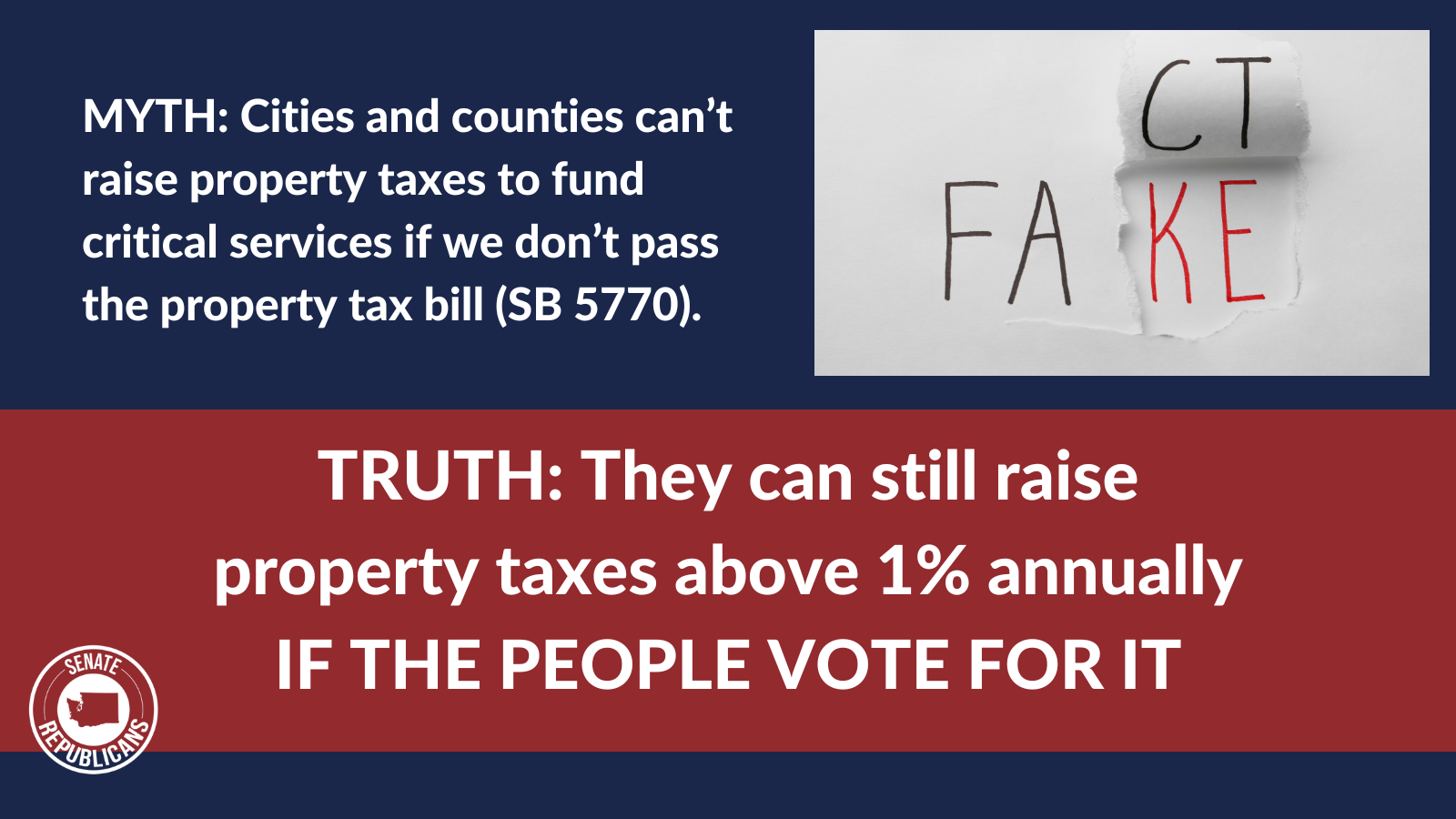

- Currently, governments can collect 1% more annually in property tax, plus any revenues attributable to the value of new construction, without voter approval.

- The increase would apply to local property-tax levies.

- As originally introduced, the Department of Revenue estimated that raising the annual levy-growth cap to 3% would cost Washingtonians $12 billion more over the next 10 years.

- With the substitute that was introduced, that lowers to $6 billion because it would not apply to state property tax.

- It would also have a compounding effect, with the increase continuing to escalate over time.

Property Taxes are Too Low… Seriously?

Washingtonians pay $6,220 per person a year in state & local taxes.

That is 13th highest in the country, according to our state Department

of Revenue, exceeding the median state (New Hampshire) by over $1,000

per person.

What about our neighboring states?

• Oregon: $5,234 (nearly $1,000 per person less)

• Idaho: $4,164 (over $2,000 per person less)

A decade ago, we ranked 22nd highest in the country, much closer to the

median tax burden.

Washington ranks 5th-worst in the country in housing affordability,

a metric that compares median incomes to the mortgage for a

median-priced home. This is most certainly a direct corollary to why

our state also ranks in the bottom quartile of all states in

homeownership (65%).

Adding more costs will only make homeownership more unaffordable

and reduce homeownership opportunities. This is the wrong direction.

What the Bill’s Proponents Say

- The 1% limitation on property tax increases that came out of voter-approved Initiative 747 is arbitrary and severely inhibits the ability of the state, counties, cities, and other special districts from providing critical community services.

- Increasing the rate will restore the primary tool state and local officials use to fund public schools, law enforcement, fire departments, and other services.

- Property taxes are the primary revenue source for counties, that are responsible for public safety and the administration of criminal justice.

- Raising the cap will provide the funding the state needs in coming years to provide education for students with disabilities.

The Bottom Line

- Raising property taxes would make the affordability crisis in our state worse. Lifting the 1% cap on annual growth goes against the will of the voters.

- Government doesn’t have a revenue problem. It has a spending problem.

- Tripling the growth rate of the property tax limit is just plain wrong. Can’t Washingtonians get a single year where Democrats aren’t digging deeper into their pockets?

- Democrats’ concern for public safety seems hollow given how their policies have gutted police departments, vilified law enforcement, put offenders’ rights above victims’ rights, and created a revolving door in our criminal justice system.

- Funding services for children with disabilities should NEVER depend on a new tax. These programs should be funded BEFORE other programs are funded out of the budget.

- Democrats like to say that additional money is needed to fund things we are already required to provide. Their tactic is to fund new spending out of the budget and say they need new money to fund core programs – to meet our constitutional obligations. It’s manipulating the public into allowing them to grow spending.

- Property tax increases hit everyone. They hit seniors on fixed incomes, middle class families trying to afford higher prices on gas and groceries, and renters who will pay higher rents to cover the higher taxes that housing providers have to pay on multi-family units.

- Increased property taxes also make inflation worse because business owners have to raise prices to cover the increased overhead.

- Higher property taxes translate into higher housing costs, for homeowners and renters alike. How can Democrats say they want to provide affordable housing while also making housing more expensive for everyone?

- We have a severe housing shortage. Owning a home is increasingly out of reach for many, even with rising incomes across the state, because they simply can’t save enough to break into the housing market. This makes the problem worse.

- Higher property taxes will put more people on the street.

Over last 10 years (2012-21):

- State revenue: 6.5% avg annual growth

- Five largest cities: 6.5% avg annual growth

- 30 largest cities: 6.1% avg annual growth

- Counties: 5.7% avg annual growth

Inflation average (2012-21):

- Implicit Price Deflator (IPD) = 1.6% avg annual growth

- Consumer Price Index (CPI) = 2.4% avg annual growthGovernment Revenue Growth Over Last Decade Over last 10 years (2012-21):

- State revenue: 6.5% avg annual growth

- Five largest cities: 6.5% avg annual growth

- 30 largest cities: 6.1% avg annual growth

- Counties: 5.7% avg annual growth

Inflation average (2012-21):

- Implicit Price Deflator (IPD) = 1.6% avg annual growth

- Consumer Price Index (CPI) = 2.4% avg annual growth