43,680 people signed in to oppose the property tax bill (SB 5798) during the March 31 committee hearing.

That’s a Senate record – fivefold.

Download a list of tax bills in the Senate and the House of Representatives.

DOWNLOAD THE MESSAGING ON SENATE BILL 5798

Burdening Taxpayers

The state of Washington is facing a multi-billion shortfall in its operating budget. Non-partisan staff in both chambers put that number at $7.5 billion. Senate Republicans introduced a balanced budget that would backfill that shortfall WITHOUT any new or higher taxes or without the catastrophic cuts in the House Democrats’ “Chicken Little” budget.

Senate Democrats, however, have argued that the shortfall is in the neighborhood of $15 billion to $20 billion, and have introduced a tax package that would take nearly $21 billion from taxpayers. (If they implement a .5% sales tax cut in 2027, it lowers to $17.5 billion. The sales tax cut isn’t expected to end up in the final budget and, if it did, it could be repealed before it takes effect.)

The Senate Democrat plan also raids the state’s safety net, known as the ‘Rainy Day Fund.’ The state treasurer — also a Democrat — has stated clearly that to do so would be a huge mistake that would leave us vulnerable to the unplanned expenses of natural disasters, future pandemics, and recessions.

The Republican budget leaves the Rainy-Day Fund intact.

Continue reading below for more details about the unnecessary taxes that will further hurt Washington.

Worst Three Democrat Taxes

Taxing Your Home

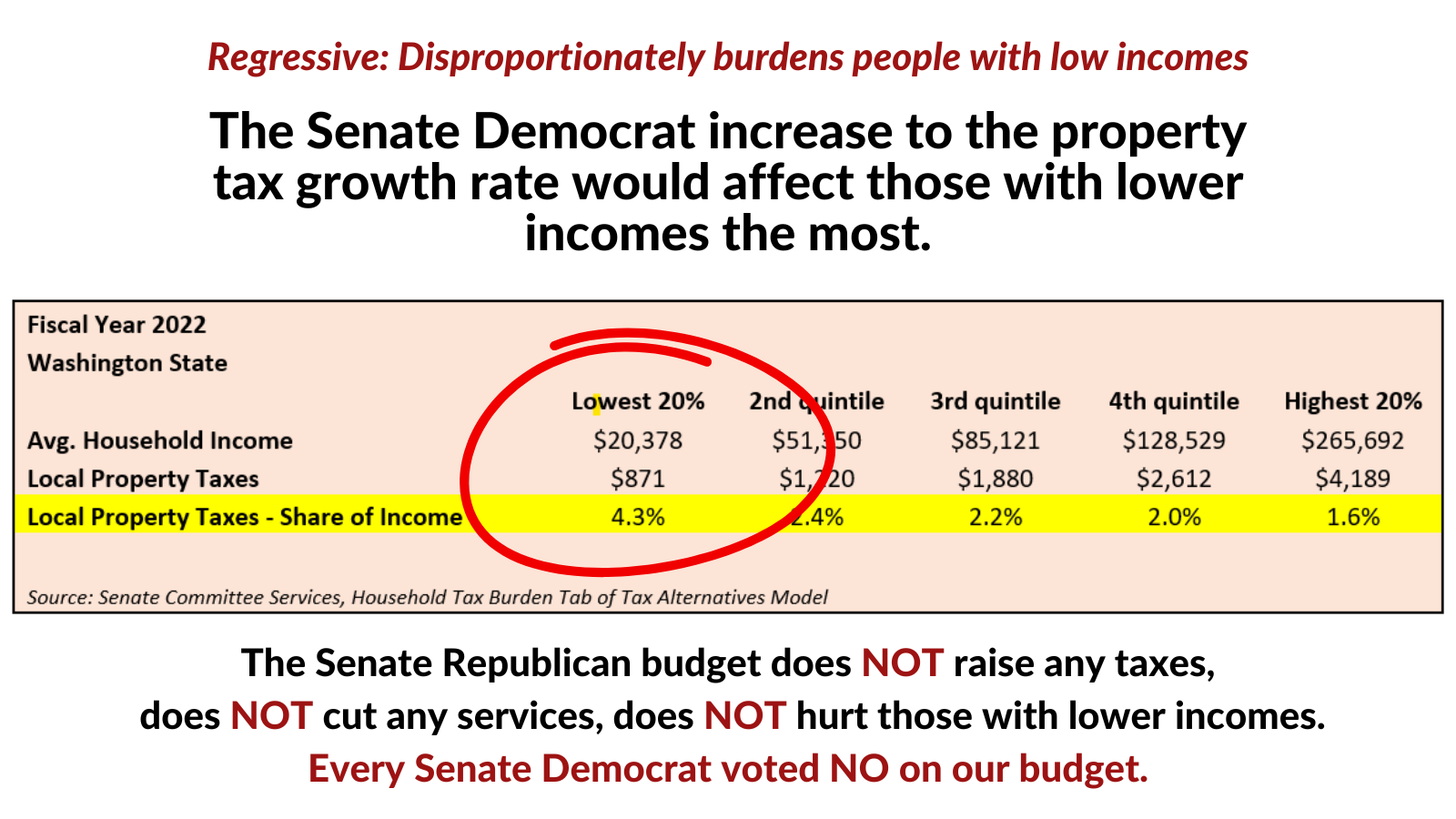

Washington is in the middle of a housing crisis and current efforts and policies can’t meet the need. The number of people who are experiencing homelessness remains high and many live on the edge of being evicted or having their homes repossessed. They worry what will happen to them if they can no longer afford to stay in their home.

It’s baffling, then, why Democrats have introduced a bill (Senate Bill 5798) that Senate Republican Leader John Braun says would, “blow the doors off our property taxes.”

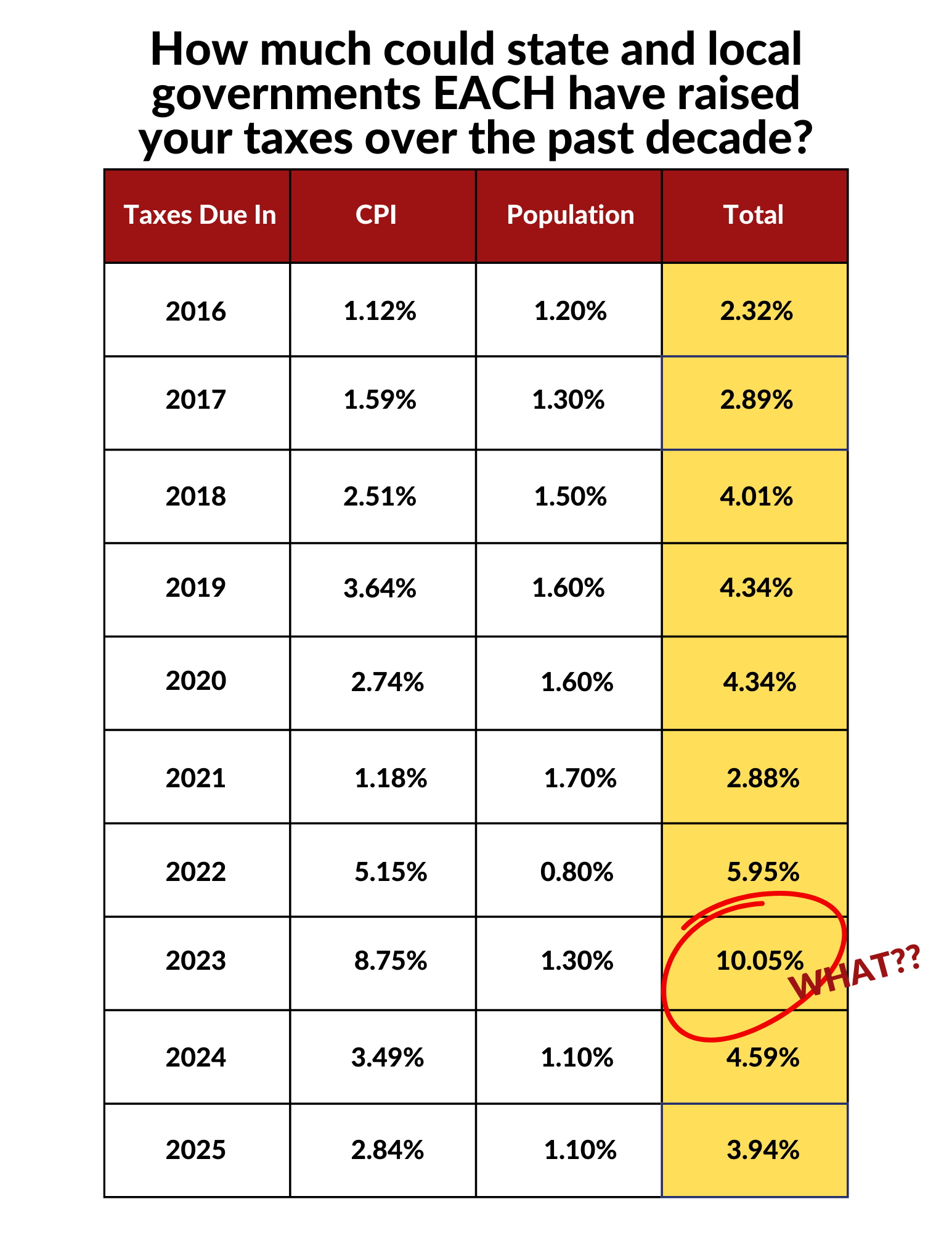

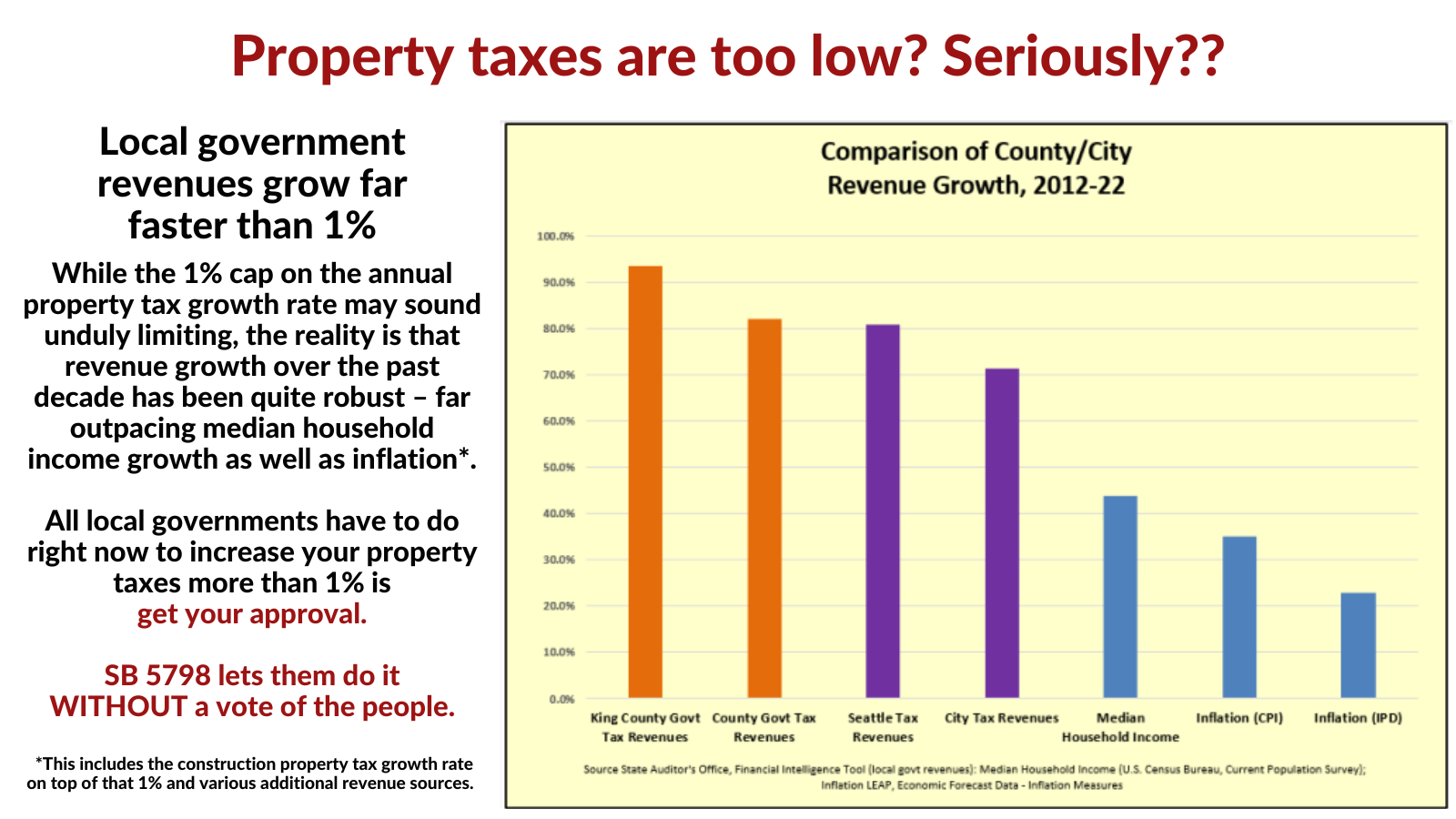

Right now, state and local governments can only raise your property taxes by 1% per year without voter approval. SB 5798 would lift that cap and allow them to raise your property taxes at a rate based on inflation and population also without voter approval.

If this policy had been in effect over the last decade, the annual average property tax growth rate state and local governments could have increased your taxes WITHOUT VOTER APPROVAL is 4.7% EACH.

Can you afford state and local governments to each increase your property taxes by 4.7% a year — or more? If you can afford it the first year, what about the next — or the next after that? Worst-case scenario — government greed results in a 9% increase in your property taxes every year and you wouldn’t be able to stop it.

Under Senate Republicans’ $ave Washington budget proposal, state or local governments that wanted to increase property taxes by anything more the current 1% cap would have to convince their voters to agree.

The Republican plan forces government to remain accountable to you.

Taxing Jobs

Senate Bill 5796 levies a 5.2% tax on businesses for payroll amounts paid to employees above the Social Security wage cap. Although it exempts businesses with an annual payroll under $7 million, it will hit Washington’s larger employers to the tune of $6.6 billion over four years. The bill also builds in a credit for taxes paid for the Seattle equivalent policy, but the credit is only a slight help as Seattle’s rate is a fraction of this tax level.

When asked if he thought this proposal would drive employers out of state, the Senate majority leader said, “Now, do we want to risk having really significant employers shift jobs outside of Washington? You know, that’s the conversation that I think we’ll need to have.”

Since SB 5797 is part of the Senate Democrat tax package, perhaps they consider that conversation over.

Taxing Innovation

“Eat the rich” is a popular protest statement for people who clamor for a state income tax and for a tax that would target only people who have achieved a level of economic success envied by others. Democrats call it a wealth tax, and it’s included in their recent tax proposal.

Senate Bill 5797 would affect people who provide thousands of family-wage jobs, make large donations to various causes, and invest in the innovation that drives Washington’s economy. These individuals, and their companies, have the means to pick up and move out of state if our laws make it too expensive to do business.

SB 5797 is a prosperity killer, taxing innovation and threatening to drive job providers to more tax-friendly states. Countries around the world who have had a so-called “wealth tax” have been abolishing it because it backfired.

Washington can’t afford this tax. We shouldn’t be implementing ill-advised taxes proven to be detrimental, in a misguided attempt to mitigate the fall out of years of poor policy decisions and overspending. The solution?

Republicans’ $ave Washington budget proposal is based on a more acute sense of self. Our proposal does not raise taxes, discourage innovation, or chase away job providers.

Facts about SB 5798

But wait...there's more

Businesses

A tax on business is a tax on consumers. Businesses, especially small businesses, can’t absorb higher costs without passing them on through higher prices. DOR also estimates 20,000 businesses will be affected.

If the goal is to close business, prevent new ones from opening and cause those that survive to lay people off and raise prices, an increase in the B&O tax is the way to go. That’s NOT what we want to for Washington. SB 5791 is a bad idea.

Storage Units

Democrats have introduced House Bill 1907, which would double-tax the rental of these storage units by applying one tax to the owner of the unit and another to the renter. It could take another $85 million from taxpayers in the first biennium after it takes effect.

HB 1907 is another unnecessary dip into taxpayers’ wallets.

Other Property

Intangible property tax: Senate Bill 5797 would tax intangible items such as stocks, bonds, patents, trademarks and intellectual property as if they were tangible property such as land. This scheme could cost Washington taxpayers $9 billion over two years and motivate others to leave the state, like Jeff Bezos did.

And More

2nd Amendment tax: House Bill 1386 would levy an additional 11% sales tax on firearms and ammunition, costing legal gun-owners $36 million in the first biennium for exercising their 2nd Amendment rights. It will do nothing to deter gun crime because criminals who need guns will not buy them legally and will not pay the tax.

Video

VIDEO: Washington, let’s talk taxes! Senate Democrats are pushing a massive tax hike that affects everyone—homeowners, renters, businesses, and consumers. But there’s a better way! Senate Republicans’ $ave Washington budget funds schools and services without raising taxes. Tell your legislators: No new taxes! SaveWA.org

VIDEO: Sen. Chris Gildon, R-Puyallup, explains how a proposal from Senate Democrats to increase the “business and occupation” tax imposed on Washington employers really ends up costing everyday people more, when they purchase products and services.

Senate Republican Statements

Sen. John Braun

“The proposal relies on more than $17 billion in new or higher taxes, including an increase in the amount state and local governments can raise property taxes annually without voter approval. Last year, Democrats wanted to triple the allowable growth rate from 1% to 3%, but didn’t succeed because of such strong opposition. But this proposal eliminates any cap. Property owners could face annual increases of 8% or more — year after year — with no recourse. This could force many homeowners and renters out of their homes.”

Sen. Chris Gildon

“The $ave Washington approach from Senate Republicans doesn’t need to raise property taxes or put state workers on furlough to balance. There isn’t a single tax increase or a single service cut. It proves we can support our shared priorities, including full funding for K-12 and services for our most vulnerable neighbors, without asking working families to pay more.”

Sen. Nikki Torres

“They claim these choices were the result of ‘thoughtful conversations,’ but the truly thoughtful approach is in the $ave Washington budget we unveiled March 11. It funds the priorities we share, including $100 million in grants to hire law-enforcement officers, without all the Democrat downside. There are no new taxes or service cuts in our budget, and it looks even better now that we can all see what the majority wants.”

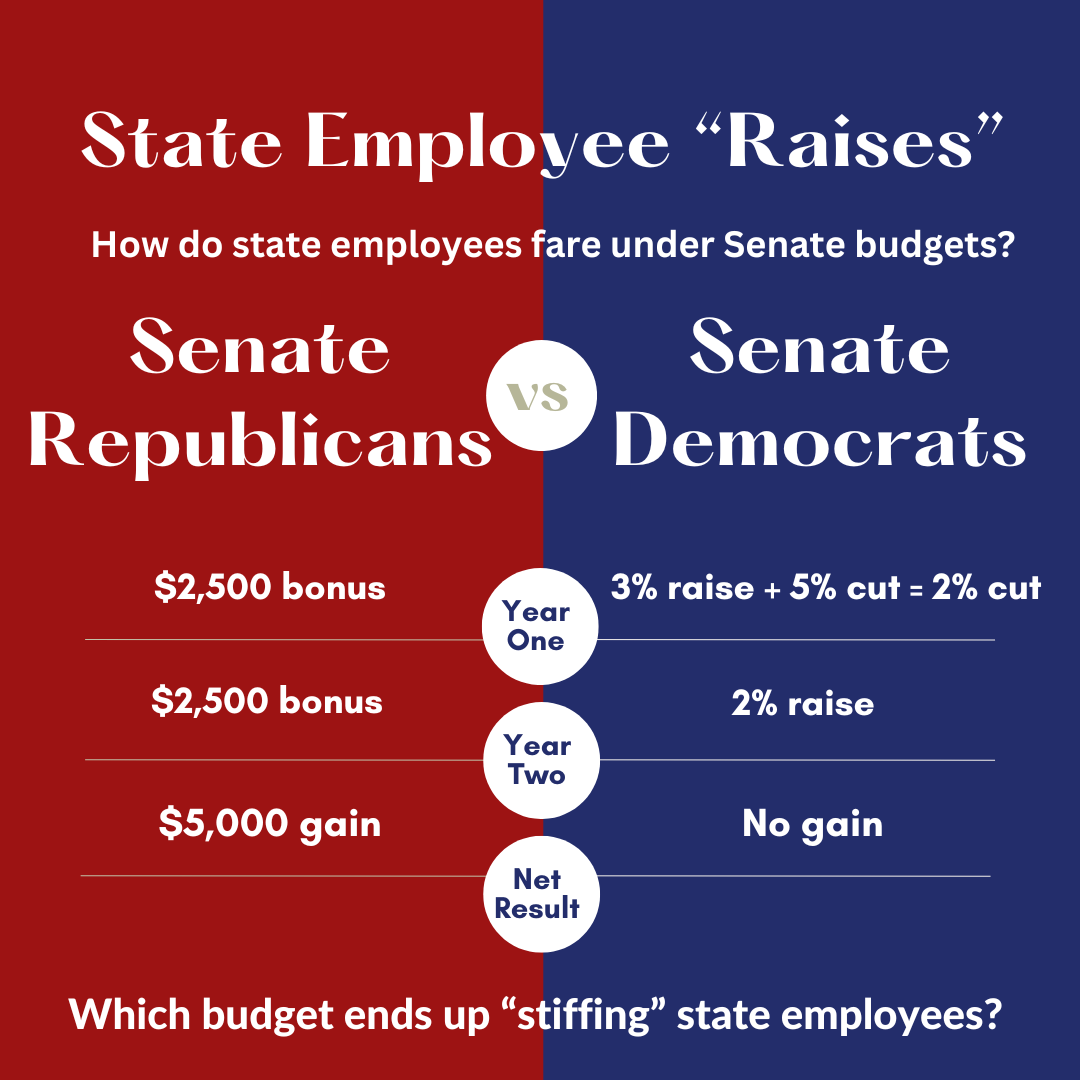

Broken promises to state employees

It came as a surprise for many state employees when, in the later part of March, Democrats introduced a package of tax bills that included a 5% pay cut for state employees.

What would that look like?

- Year one: State employees get a 3% raise and suffer a 5% cut to that revised salary.

- Year two: State employees get a 2% raise based on the salary they had before the cut.

- Result: State employees do not get the full raises they were promised.

Democrats end up stiffing state employees after all.

Podcast

VIDEO: In this episode of Elephant in the Dome, Senate Republican Leader John Braun talks about the impact of proposed tax increases in Washington. He discusses the Republican budget alternative, concerns over new payroll and wealth taxes, and how these policies could affect affordability, job growth, and economic stability in the state.

Government Spending

The regular 2025 legislative session will end April 27. By then, lawmakers must deal with a budget gap that is self-inflicted, caused by chronic overspending. Republicans will work to protect funding for the services and programs valued most by the people of Washington.