REMINDER: Sign in CON

Don’t miss the opportunity Monday, March 31 to sign in CON on the Democrat bill to increase the annual property tax growth rate that state and local governments can charge without your approval. It and other tax bills will be heard in the Senate budget committee (Ways & Means) at 4 p.m. Don’t let Democrats remove the voter-approved cap on how much the state and local governments can increase your property taxes every year WITHOUT A VOTE OF THE PEOPLE.

PODCAST:

The largest tax increase in Washington state history —

Sen. Braun breaks it down for us

Listen to the latest episode of Elephant in the Dome with Sen. John Braun. Sen. Braun covers the various taxes included in the Democrats’ proposal for the largest tax increase in history. Worst of these is a bill to remove the cap from the amount that state and local governments can increase your property taxes annually WITHOUT VOTER APPROVAL. taxmadness.com

A closer look: Senate Democrat operating budget proposal

Senate and House Democrats released their proposals for the 2025-26 operating budget. Senate Democrats would increase the size of the budget to $78.5 billion, while House Democrats plan a slightly more modest increase of $77.8 billion.

The Senate Democrat plan includes raiding the state’s ‘rainy-day fund’ and raising taxes by about $21 billion over the next four years. The ‘rainy day fund’ is what the state uses to help pay for unplanned expenses, such as disaster response or a recession.

“Our high-cost, high-tax, high-regulation, anti-business environment has already shooed

away the golden goose, and this legislative

session is all but certain to kill it.”

President/CEO

Bellevue Chamber of Commerce

Other lowlights from the Senate Democrat budget:

- $12.1 billion in new spending over four years

- Raises college tuition by about $3,000 for a 4-year degree

- Eliminates college financial aid for roughly 17,000 individuals

- Honors 5% state employee raises agreed to by former governor, but cuts their pay by 5% through furloughs

- Doubles the annual bed fees for long-term care, such as nursing homes and assisted living — private-pay residents will bear the $90 million cost

- 50% increase to the Discover Pass, raising the cost of using your state parks

- Increases hunting/fishing licensing and fees by 40%

- Increases liquor license fees for restaurants, bars by 50%

One other significant disappointment with the Senate Democrat budget is that the grants needed to hire more law-enforcement officers are NOT included. Since Governor Ferguson said he will veto any budget that does not include this item, we hope he follows through if necessary.

Read more of our members’ reactions to the Senate Democrat operating budget proposal.

- Senate Republican Leader John Braun

- Sen. Chris Gildon and Sen. Nikki Torres, Republican budget leads

Read more about the spending in the Senate Democrat budget proposal and the largest tax increase in the history of Washington.

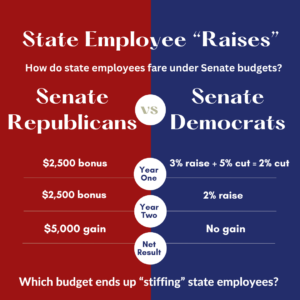

What about the raises for state employees?

Senate Republicans have been very clear — with a multibillion-dollar budget shortfall, the state can’t afford to pay for the 5% raises negotiated by former Governor Inslee. A recent public survey showed that most Washingtonians don’t want to pay higher taxes to cover those raises either.

Instead, our $ave Washington budget proposal includes a $5,000 bonus for every state worker, given in two annual consecutive payments of $2,500. Over those two years this bonus would benefit those making less than $80,000 per year more than a 5% raise.

In contrast, a percentage-based salary increase favors those at the higher end of the pay scale.

Democrats said our plan would be “stiffing” state workers because they were promised 5% raises. They indicated that their budget would include the raises. And it does – but in name only.

Under the Senate Democrat plan, employees get the raise as negotiated — 3% the first year and 2% the second. However, the budget they announced this week would also implement furloughs, which have the effect of a 5% salary cut in the first year.

This results in a 2% pay cut the first year. With the remaining 2% of the pay increase going into effect the second year, the net gain is zero. The net gain under our budget is $5,000.

Bottom line: State employees fare better under the Senate Republican budget. They get “stiffed” by the Senate Democrat budget.

Committee Highlights for March 31 – April 3

SHR = Senate Hearing Room

John A. Cherberg Building

Capitol Campus

Monday, March 31

Labor & Commerce

10:30 AM SHR 1

Executive Session

- ESHB 1141 – Concerning collective bargaining for agricultural cannabis workers. (55-40)

- ESHB 1332 – Concerning transportation network companies. (59-36)

Human Services

1:30 PM SHR 4

Executive Session

- E2SHB 1232 – Concerning private detention facilities. (56-38)

- ESHB 1233 – Concerning work programs for incarcerated persons. (58-39)

- SHB 1390 – Repealing the community protection program. (55-42)

Transportation

4:00 PM SHR 1

Public Hearing

- ESHB 1423 – Authorizing the use of automated vehicle noise enforcement cameras in vehicle-racing camera enforcement zones. (57-40)

- SHB 1244 – Concerning training as an alternative to driver license suspension for the accumulation of certain traffic infractions. (58-39)

Ways & Means

4:00 PM SHR 4

Public Hearing

- SB 5797 – Enacting a tax on stocks, bonds, and other financial intangible assets for the benefit of public schools.

- SB 5796 – Enacting an excise tax on large employers on the amount of payroll expenses above the social security wage threshold to fund programs and services to benefit Washingtonians.

- SB 5798 – Concerning property tax reform.

- SB 5794 – Adopting recommendations from the tax preference performance review process, eliminating obsolete tax preferences, clarifying legislative intent, and addressing changes in constitutional law.

Tuesday, April 1

Law & Justice

8:00 AM SHR 4

Executive Session

- E2SHB 1218 – Concerning persons referred for competency evaluation and restoration services. (53-44)

- EHB 1574 – Protecting access to life-saving care and substance use services. (56-41)

- ESHB 2015 – Improving public safety funding by providing resources to local governments and state and local criminal justice agencies, and authorizing a local option tax. (54-42)

Labor & Commerce

10:30 AM SHR 1

Executive Session

- ESHB 1331 – Concerning transportation network companies. (59-36)

- ESHB 1622 – Allowing bargaining over matters related to the use of artificial intelligence. (58-38)

- ESHB 1551 – Extending the cannabis social equity program. (57-39)

Environment, Energy & Technology

1:30 PM SHR 1

Executive Session

- E2SHB 1912 – Concerning the exemption for fuels used for agricultural purposes in the climate commitment act. DENT

- 2SHB 1503 – Furthering digital equity and opportunity in Washington state. (61-34)

- ESHB 1483 – Supporting the servicing and right to repair of certain products with digital electronics in a secure and reliable manner to increase access and affordability for Washingtonians.

Ways & Means

4:00 PM SHR 4

Public Hearing

- SB 5195 – Concerning the capital budget.

- SB 5194 – Concerning state general obligation bonds and related accounts.

Thursday, April 3

Ways & Means

1:30 PM SHR 4

Public Hearing

- 2SHB 1587 – Encouraging local government partner promise scholarship programs within the opportunity scholarship program. (58-38)

- 2SHB 1183 – Concerning building code and development regulation reform. (56-39)

- SHB 1392 – Creating the Medicaid access program. (56-39)

Executive Session

- SB 5195 – Concerning the capital budget.

- SB 5194 – Concerning state general obligation bonds and related accounts.

- HB 1494 – Concerning the property tax exemptions for new and rehabilitated multiple-unit dwellings in urban centers. (63-34)

- SHB 1791 – Increasing the flexibility of existing funding sources to fund public safety and other facilities by modifying the local real estate excise tax. (60-37)