20 Senate Democrats think your property taxes are too low, so they have sponsored Senate Bill 5770.

It would triple the growth rate of state and local property taxes by increasing the cap from 1% to 3%. In just six years, it would cost taxpayers $4.1 billion.

FISCAL IMPACT

Read the Department of Revenue’s fiscal note for SB 5770

Bottom line: The amount of revenue this generates is enormous compared to the recent ‘Move Ahead Washington’ transportation package.

- 6-year estimate: Increase property taxes by $4.1 billion

-

- FY 24: $108 million ($48 million state & $60 million local)

- FY 25: $322 million ($143 million & $179 million)

- FY 26: $548 million ($245 million & $303 million)

- FY 27: $786 million ($353 million & $433 million)

- FY 28: $1.045 billion ($469 million & $571 million)

- FY 29: $1.312 billion ($593 million & $719 million)

- Every year about an additional $250 million more is collected than the prior year (note: this delta will grow over time)

- 10-year estimate: $12 billion increase in property taxes over current law

- By law, OFM will have to produce a 10-year fiscal impact estimate on this bill

- With the growth rates shown above, the I-960 10-year estimate should show a roughly $12 billion impact over 10 years (through fiscal year 33)

- 16-year estimate (which is time frame transportation budget writers used in describing their 2022 package): $31 billion increase in property taxes over current law

- By comparison, transportation’s ‘Move Ahead Washington’ was a $17 billion package

- The $31 billion estimate is likely a conservative projection, estimating only a $250 million per year increase to revenues in out years

MORE BAD NEWS

Washingtonians already have a comparatively high tax burden

Per DOR’s annual comparative tax report, Washingtonians have the 13th highest state and local tax burden per capita in the country at $6,220 a year in taxes paid per person. Our immediate neighbors? Oregon ($5,234) and Idaho ($4,164).

Indeed, the median state, New Hampshire, clocks in at $5,154, meaning Washingtonians pay over $1,000 more a year than the median state in taxes.

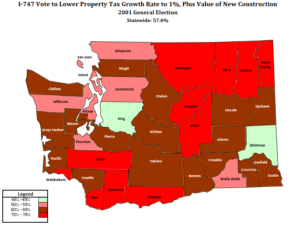

The 1% Limit was approved by Voters in 2001

See map below for the county-by-county vote. The Supreme Court overturned the initiative in 2007 on a 5-4 vote on grounds that it was ambiguous and misleading, but the Legislature re-enacted the law in a special session later that month.

Government Revenue Growth Over Last Decade

Over last 10 years (2012-21):

- State revenue: 6.5% avg annual growth

- Five largest cities: 6.5% avg annual growth

- 30 largest cities: 6.1% avg annual growth

- Counties: 5.7% avg annual growth

Inflation average (2012-21):

- Implicit Price Deflator (IPD) = 1.6% avg annual growth

- Consumer Price Index (CPI) = 2.4% avg annual growth