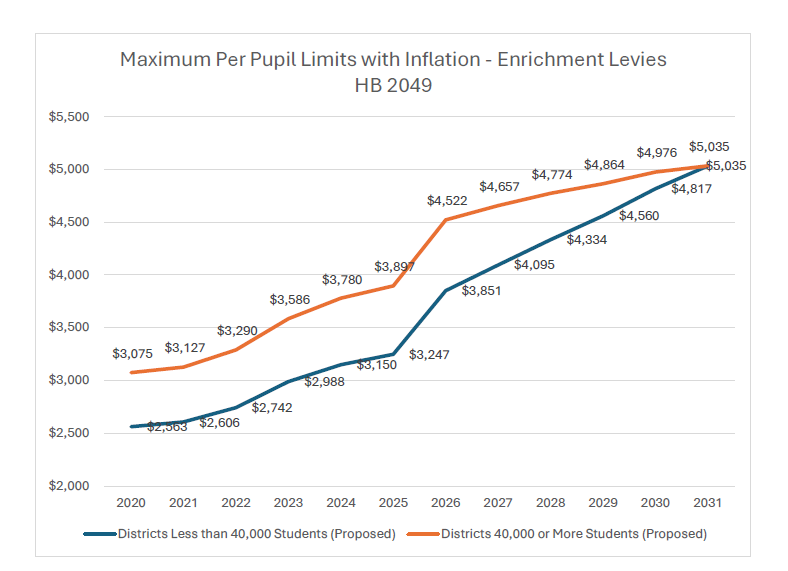

Areas outside Seattle will see an increase of nearly 20% next year

and 55% over the next 6 years.

OLYMPIA…Contrary to news-media reports indicating the Legislature’s majority Democrats have abandoned their push for higher property taxes, House Bill 2049 would still allow significant property-tax increases by raising the cap on local school-district levies, which generate funding beyond what the state pays for basic education.

HB 2049 is identical to Senate Bill 5812, introduced in the Senate this past week. The House bill’s prime sponsor has proposed an amendment to his bill that would remove the tripling of the 1% annual cap on how much state and local governments can increase property taxes each year without a vote of the people. However, the bill would still allow an increase in the school-levy cap, opening the door to the same reliance on local-levy funding that led to the state Supreme Court ruling in the K-12 funding case McCleary v. State of Washington more than a decade ago.

Senate Republican Leader John Braun, R-Centralia, and Sen. Nikki Torres, R-Pasco, the assistant lead Senate Republican on the operating budget, shared the following reactions.

From Sen. John Braun:

“Democrats appear to be backing away from the original plan to triple the 1% annual cap on property-tax increases without voter approval, but no one should be fooled – because their new focus appears to be just as troubling for homeowners and renters. House Bill 2049 still aims to lift the cap on local school levies — a change that might benefit wealthier areas like Seattle but will only deepen education-funding inequities across Washington.

“We’ve seen this before. It’s the same kind of policy that triggered the McCleary decision, when the court ruled that state government had failed to fund K-12 education properly. House Bill 2049 threatens to take us right back there.

“Under this proposal, school districts with high property values will be able to pursue even more money for their schools — while families in rural and lower income districts, with lower property values, stand to pay far more in taxes without a comparable investment in their children’s education. This would be a throwback to the ‘haves’ and ‘have-nots,’ when educational opportunities were dictated by ZIP code – a situation Republicans worked hard to change years ago. It’s as though the majority wants to set the stage for a new McCleary 2.0 lawsuit, which would be completely wrong – especially in the final days of a legislative session. Not only is it wrong for our schools and students, it would require the state to spend millions defending the resulting inequities in court.

“When discriminatory policies like this move forward, it’s hard to take seriously any claim that Democrats are prioritizing equity or considering the real impact of legislation on low-income communities and communities of color. The message that they care is undermined by the real harm a tax policy like this can do.”

From Sen. Nikki Torres:

“It appears the amended version of House Bill 2049 will raise the local levy authority from a 1% cap to $500 per pupil above the rate of inflation during the first year, and by 3.3% above inflation in future years. Right now, inflation in Washington is 2.5%. This is a huge step toward the inequities of McCleary 2.0.

“Before the McCleary fix, wealthier districts could pass high local levies while rural and low-property-value communities, like many in my district, couldn’t keep up. The result? Inequitable funding, unequal opportunity, and a school system that failed to meet the state’s constitutional duty. We were forced to fix this enormous inequity, and Senate Republicans led that effort, crafting a funding model that gave students across Washington a fairer shot, no matter their zip code.

“The current proposal unravels that progress with barely a whisper of public input.”

Note: Before the fix, a levy rate of $1.28 raised $3,712 per student in Seattle while a rate of $4.05 raised a mere $1,267 in Pasco.