Our state’s families and employers are already paying too much in taxes. They need legislators to find ways to end wasteful spending, deliver services at less cost and… $ave Washington!

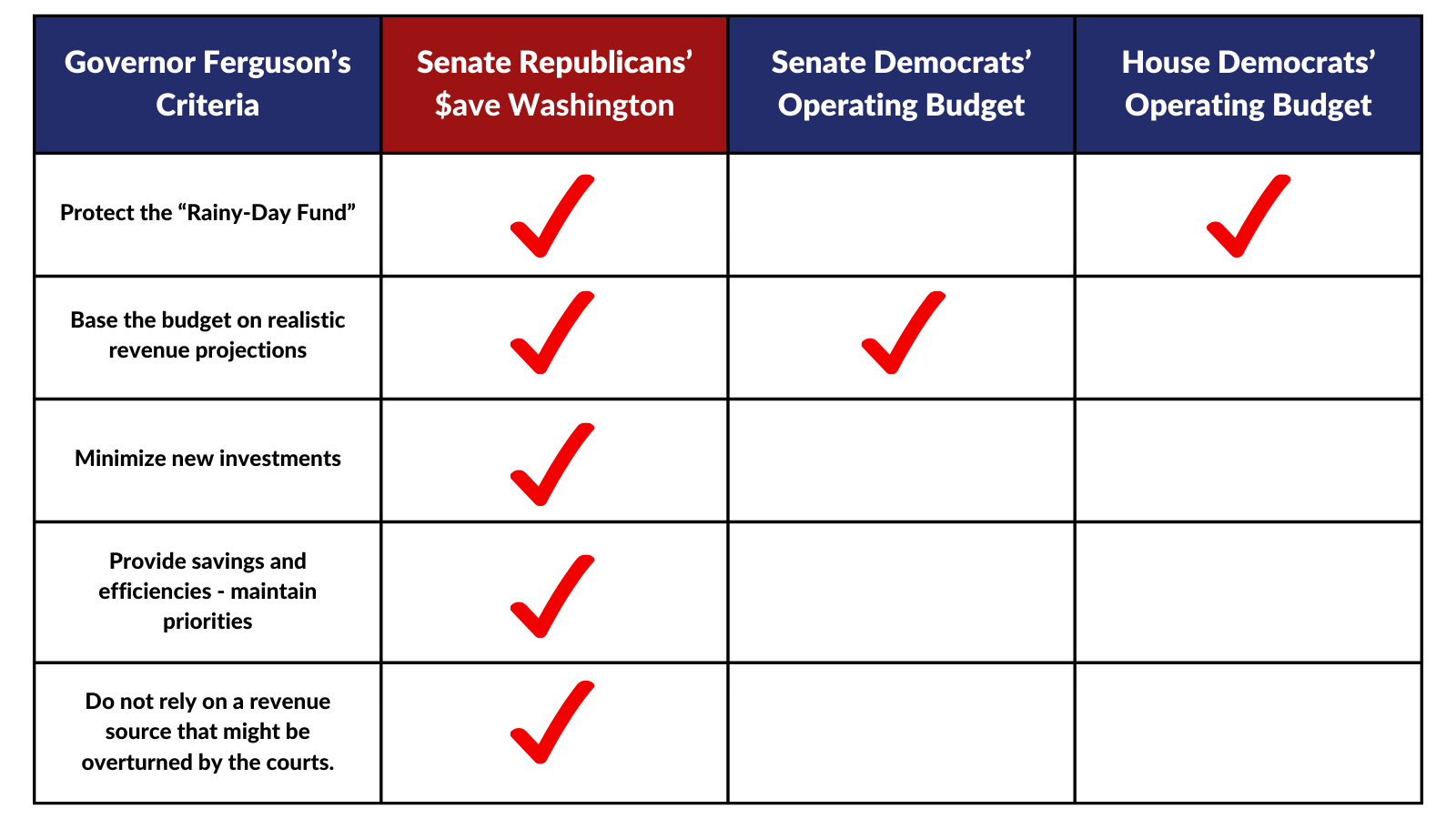

One budget meets all five criteria — OURS

98% of Washingtonians feel taxes in our state are too high or about right

Napolitan News Service Survey of 800 Registered Voters in Washington conducted January 3-7, 2025

Our Budget

-

No tax increases: This budget does not rely on a single tax increase to close the deficit. Democrats this year have proposed several property tax increases, wealth tax increases, a can/bottle deposit tax, a vehicle mileage tax, and more.

-

No fee increases: This budget does not rely on a single fee increase to close the deficit. Democrats this year have proposed fee increases for state parks, hunting, and fishing.

-

Funding at near-record levels: Prudent spending decisions – often simply reverting to 2023 or 2024 spending levels – make unpopular tax hikes unnecessary while providing near-record funding to social services.

The $ave Washington budget funds the shared priorities of the people we serve… without raising taxes.

Democrats have proposed wildly irresponsible ways to solve state government’s budget situation. One is an all-cuts approach*, which Democrats admit would be “catastrophic.” The other would raise taxes by a record $13 billion in just four years, which would make living in Washington even less affordable.**

Senate Republicans have proposed a third way, guided by priorities all Washingtonians can support.

* The budget from former governor Inslee that uses existing revenue; was not filed as legislation.

** Senate Bill 5167 | House Bill 1198 originally proposed by former governor Inslee.

VIDEO

EVERYTHING YOU NEED TO KNOW

The People of Washington have faced a period of rising costs and economic uncertainty. The first thing residents do in that situation is examine spending priorities and ensure they reduce spending that isn’t critical. This budget shows that it’s possible to continue investing in those critical priorities, without increasing the burden on WA taxpayers.

PODCAST | RADIO

State Senator Chris Gildon discusses the budget realities facing Washington. With a clear stance against new taxes, Gildon outlines how education funding can be preserved, fiscal responsibility achieved, and collective bargaining agreements reimagined.

State Senator Chris Gildon discusses the budget realities facing Washington. With a clear stance against new taxes, Gildon outlines how education funding can be preserved, fiscal responsibility achieved, and collective bargaining agreements reimagined.Balancing Budgets/Defying New Taxes: Sen> Chris Gildon’s Vision for Washington on The Jason Rantz Show

Sen. Chris Gildon Explains Senate Republican Budget Plan on KVI

Sen. Chris Gildon Talks Budget Fix with Lars Larson: No New Taxes Needed

AUDIO: Republican budget leader says drop in revenue forecast confirms need to limit spending, avoid new taxes

A forecast revealing an 845-million-dollar drop in projected state revenue is prompting calls for restraint in Washington’s budget planning.

Tracy Ellis explains.

Facts about the budget situation

- State government has more money coming in, not less. An additional $5 billion is expected in the upcoming budget cycle. That’s a 7.6% increase — do you expect your household income to go up that much?

- Demand for state-supported services is flat or down. Our public schools are serving fewer students than in 2019. The number of Medicaid clients has fallen 150,000 since 2024. The total population in Washington prisons is down 4,000 from pre-pandemic levels.

- The budget shortfall has declined since December. Non-partisan legislative budget-committee staff recently calculated state government is $6.6 billion short of being able to maintain services and programs at today’s levels. That’s a $100 million drop since December’s estimate.

Their Budgets

Their all-cuts approach

- They admit this could result in “catastrophic” cuts to Medicaid, health care, and public-health funding; human services and early-learning programs; services for seniors, people with developmental disabilities, and those needing long-term care

- Over $1 billion in reductions to higher education

- But… it threatens these cuts while protecting back-to-back pay raises for workers who on average are paid more than private-sector workers in 38 of 39 Washington counties

Their new-taxes approach

- SB 5167 | HB 1197

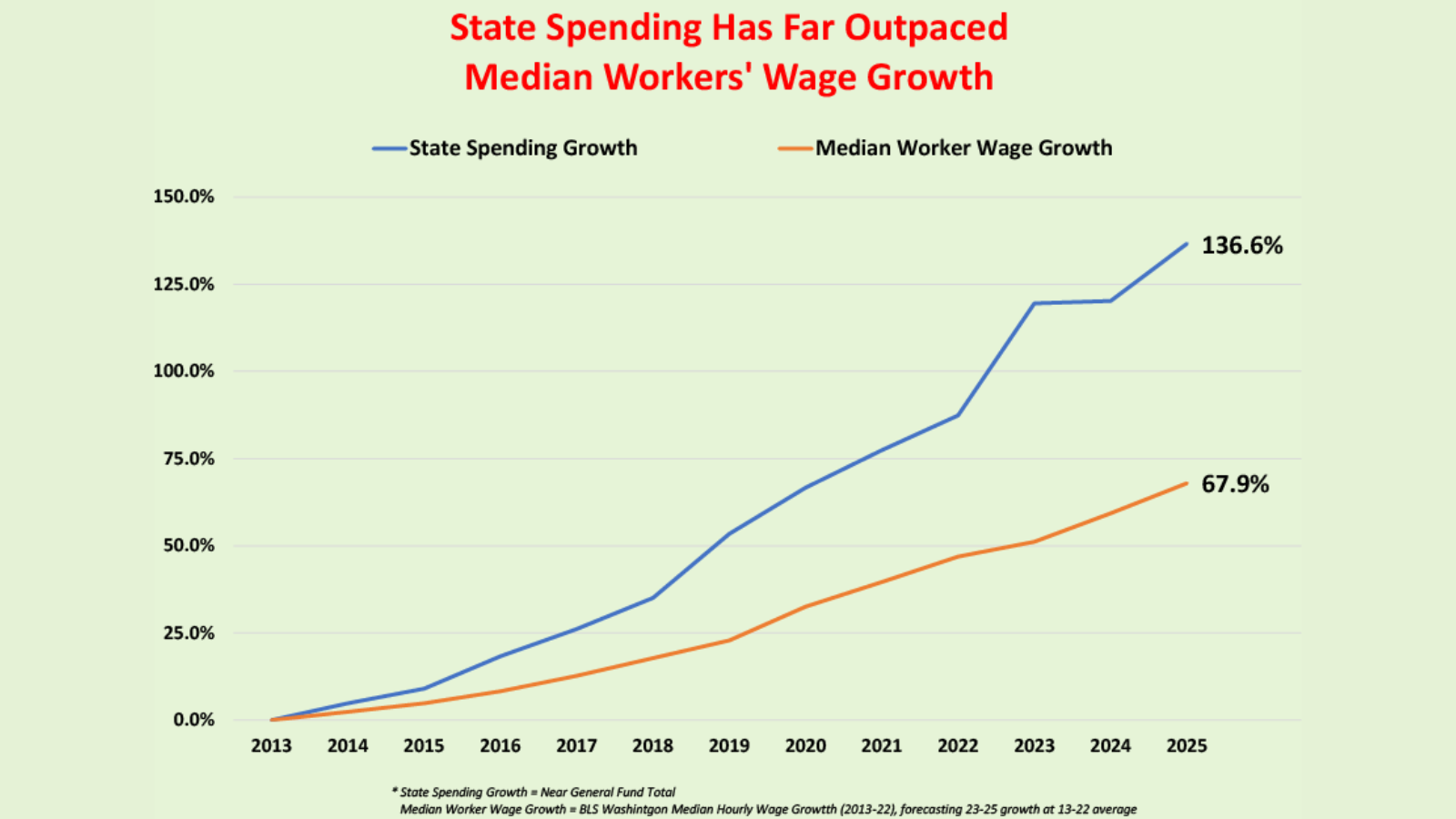

- Would be the fifth consecutive budget with a double-digit percentage spending hike…continuing the chronic overspending that produced the multibillion-dollar budget gap we face

- $13 billion in new taxes over 4 years to support 500+ pieces of new spending

- New spending includes back-to-back pay raises for workers who on average are paid more than private-sector workers in 38 of 39 Washington counties… and another 2,275 state jobs

$ave Washington Budget

The $ave Washington way: Funds our shared priorities without raising taxes

“It’s the right thing to do.” —Sen. Chris Gildon.

- Reasonable 5% growth in spending

- Increases funding for K-12, investing more in students while honoring educators

- Preserves and maintains services for WA’s most vulnerable residents

- Makes smart investments in public safety that will offer big benefits

- Demands accountability for health-care spending, tightens state government’s belt

- Protects “rainy-day” fund for when our state truly needs it

More support for state’s paramount duty

- For the first time in six years, K-12 would receive a larger share of the budget

- Hundreds of millions more for special education and classroom materials; none in new-taxes budget

- Preserves bonus for nationally recognized teachers, unlike new-taxes budget

- Invests in effort to reduce chronic absenteeism

No tuition increases at state-run colleges

- Keeps college affordable by respecting historic tuition cap set in 2015

- Democrats would allow return to annual tuition hikes, cut financial aid (SB 5785)

- 1,800 new slots for resident students

Protecting WA’s most vulnerable residents

- Democrats’ all-cuts approach threatens services for seniors, people with developmental disabilities, and those needing behavioral-health treatment; $ave Washington budget preserves and maintains them

- Freezes rates and eligibility threshold for state-subsidized childcare, but no one goes backward

- Policy change in $ave Washington budget package would reduce regulatory burden on providers, saving costs

Makes progress on public-safety priorities

- Funds the policy in SB 5060, supported by Governor Ferguson, which would make grants available to communities for hiring law-enforcement officers

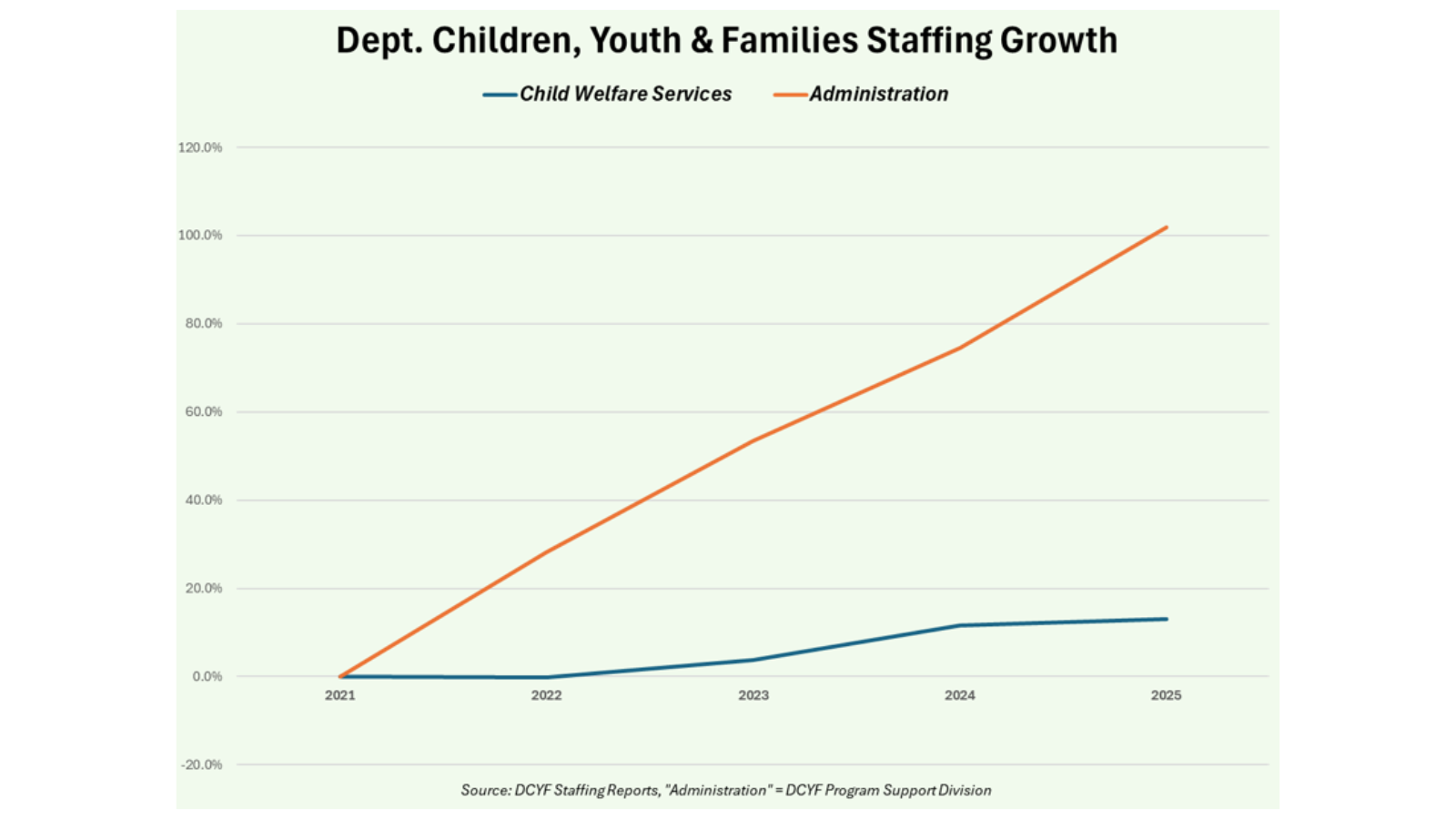

- Reforms at Department of Children, Youth and Families would reduce administrative costs in favor of increasing front-line workers – “boots on the ground”

- Saves $110 million by addressing unused capacity at women’s prison, work-release centers

- Avoids Democratic proposal to open costly new prison wing for juvenile offenders in favor of sensible policy on safe operational capacity at facilities like Green Hill School

Doesn’t increase cost of recreational opportunities

- Democrats and Republicans agree Washington is a great place to play… but only Democrats would make it more expensive to play

- $ave Washington budget freezes fees for state parks and hunting and fishing licenses

- Democrats would raise park fees by 50% and hunting/fishing license fees by 38%, knowing it would cause decline in park use and license purchases (SB 5390 | SB 5583)

More accountability for health-care dollars

- No reductions in service/eligibility

- Saves hundreds of millions by moving delivery of certain services away from managed care organizations

- $ave Washington budget package includes policy change to stop paying Medicaid premiums for people who live outside Washington

The majority Democrats act like the choice is between catastrophic spending cuts or huge tax hikes – as though there’s no other way to deal with the multibillion-dollar shortfall in the budget. That simply is not true.

Realistic about true cost of employee pay raises

- When a budget shortfall is $6.6 billion (or more, as Democrats claim), it’s not credible to claim $4 billion in pay raises are “financially feasible” as required by state law

- Former governor agreed to costly package of salary increases and benefits before the shortfall was clearly identified; Governor Ferguson should not be bound by it

- A $5,000 bonus for each state employee is a progressive way to recognize the contributions of public servants while also respecting taxpayers

Tightens state government’s belt

- Governor wants across-the-board savings; $ave Washington approach agrees but requires smaller amount

- Public-safety agencies and K-12 are exempt; agencies that provide direct services must find 1.5% in savings, others must achieve 3%

- Legislative branch must find 6% in savings

- 10% reduction in middle management

Makes better use of surplus and settlement funds

- $ave Washington approach repurposes $2.5 billion from pension-fund surplus without affecting pension payouts

- Under Climate Commitment Act, funds may be used to support Working Families Tax Credit, so $ave Washington makes that shift

- Better to use CCA funds to support families than non-governmental organizations that lack transparency

The $ave Washington Budget from Senate Republicans is a common-sense budget that prioritizes funding our shared priorities without placing additional burdens on hardworking Washington families.

The $ave Washington Budget from Senate Republicans is a common-sense budget that prioritizes funding our shared priorities without placing additional burdens on hardworking Washington families.

It achieves this by focusing on sustainable spending increases while ensuring no new taxes are imposed.

This responsible approach allows us to meet the needs of our communities and maintain essential services without resorting to tax hikes, demonstrating a commitment to fiscal responsibility and protecting the financial well-being of Washington families.

Our Bills

Agency mistakes are costing taxpayers hundreds of millions

- One of the fastest-growing costs to state government is for “tort liability” – meaning payouts to people who have been harmed somehow by a state agency

- State government has paid out more than $500 million in the past two years alone due to claims and judgments, and the 2025 fiscal year is on pace to be even more expensive

- Nearly 200 claims totaling $1 million or more apiece have been paid in the past four years alone, and 3/4 of those are associated with the state Department of Children, Youth and Families

- Senate Bill 5144 would increase legislative oversight of the executive branch… the fewer payouts, the more we can $ave Washington!

When programs don’t perform, let them fade into the sunset

- The performance of preferential tax rates – set primarily to encourage job creation – is regularly reviewed to see whether they should be considered for an extension or allowed to fade away… (or “sunset”)

- We can $ave Washington by putting spending programs through the same kind of performance evaluation used to decide the future of tax preferences

- Senate Bill 5145 would put expiration dates on programs established as of 2026 that spend at least $1 million in their first two years of full implementation

- Ahead of a program’s expiration date, the Legislature’s special audit/review committee will recommend whether it should be continued, modified or allowed to fade into the sunset

Create a state spending limit, with excess revenues going toward property tax relief

- Washington once had a voter-approved spending limit – which was repeatedly suspended and ultimately repealed.

- Senate Bill 5151 would establish a new limit on state spending, tied to the long-term annual average of median worker wage growth in the state – which is at present around 4%.

- Revenue collected above the limit would go toward property-tax relief, by reducing the next year’s state property-tax rate.

Stop paying Medicaid premiums for people who live outside Washington

- A recent state audit found Washington is unnecessarily continuing to pay Medicaid premiums for people who have left the state and are enrolled in Medicaid elsewhere

- In one year alone nearly $135 million was lost to these double payments for people who were enrolled in Medicaid here and another state at the same time

- Senate Bill 5258 would $ave Washington by allowing for the recovery of premiums paid to managed care organizations for Medicaid enrollees who no longer live in our state

Apply common sense to childcare subsidy

- The formula for subsidizing child care has the state paying providers more than private-pay families are charged

- Senate Bill 5310 takes a “pay the lesser of…” approach that will $ave Washington taxpayers and promote equitable access to childcare services regardless of payment source

Increase affordable child-care options by reducing barriers for providers

- Washington is unfriendly to childcare providers, regulating them more heavily than 37 other states

- The burden of complying with staffing requirements, regulations that aren’t health- or safety-related, and more has depressed the availability of care, driving up costs

- Senate Bill 5416 would get rid of costly, unnecessary mandates and encourage growth in the supply of childcare providers

Ask for ideas to make government work better

- State employees and people who interact with government often can point out where agencies are being wasteful, inefficient, or worse

- Senate Bill 5146 would establish a “government efficiency portal” that offers a direct pipeline to legislative budget writers

- Suggestions may be anonymous, and ideas that result in savings may be eligible for financial awards

Don’t certify pay raises that would force tax hikes

- Prohibit Washington’s governor from setting the stage for tax increases by agreeing to collective bargaining agreements (CBAs) that are not financially feasible

- Don’t certify CBAs as financially feasible if they would require a withdrawal from state government’s “rainy day fund”

- Senate Bill 5415 would $ave Washington by keeping the cost of state-worker compensation within available revenues

VIDEO

$ave Washington is about more than saving tax dollars – it’s also about improving outcomes to ensure tax dollars are spent efficiently.

Address chronic absenteeism in our schools

- K-12 dollars are effectively lost when students are chronically absent… and it’s not good for students either

- Students who miss even 2 days per month are more likely to read at lower than their grade level and to not graduate on time

- Senate Bill 5007 would create a pilot program at the Educational Service District level to identify and provide supports to students who are or are at risk of being chronically absent

More accountability for those on public assistance

- People receiving food and cash assistance from the state are supposed to be actively seeking employment or working to improve their employability

- The percentage of those complying has fallen to 46%, from 76% in 2019

- Senate Bill 5311 would create an incentive to honor WorkFirst program requirements by allowing for the permanent disqualification of those who repeatedly fail to comply

Create campus for building health-care workforce

- Our state needs many more health-care workers to be ready for the approaching “silver tsunami” of Washingtonians whose medical needs are increasing as they age

- The Evergreen State College is not providing enough return on the taxpayers’ investment; its 2024 enrollment of 2,386 is half what it was just 10 years ago and lower than the combined enrollment at Olympia’s two traditional high schools

- Senate Bill 5424 would retire TESC and turn its Olympia campus over to the University of Washington, for conversion to a dedicated health-sciences campus

JR to 25’ is unsafe and expensive

- Mixing adults and youth in juvenile-rehabilitation facilities is a failed experiment

- Hybrid approach costs more, leads to safety issues that hinder youth-rehab efforts

- Senate Bill 5278 addresses overcrowding concerns; other reforms proposed in SB 5153, SB 5260, SB 5277

AUDIO

The Evergreen State College in Olympia would be abolished and replaced with a new health-care training school under new legislation proposed by the State Senate Republican Leader. Tracy Ellis reports.

SRC On Air: Sen. John Braun on The Lars Larson Show

Senate Republican Leader John Braun talks to Lars Larson about his effort to fix Washington’s broken juvenile-justice system. Braun’s legislation addresses safety and operational concerns at state-run juvenile-rehabilitation facilities.