Repeal the “Climate Commitment Act” and its “cap-and-tax” program

All updates to this webpage will cease at midnight on March 7. No further updates will occur until after the election in November.

Initiative 2117 would repeal “cap and trade” – known officially in the Legislature as the Climate Commitment Act (CCA). Senate Republicans have given it a more accurate moniker — cap-and-tax.

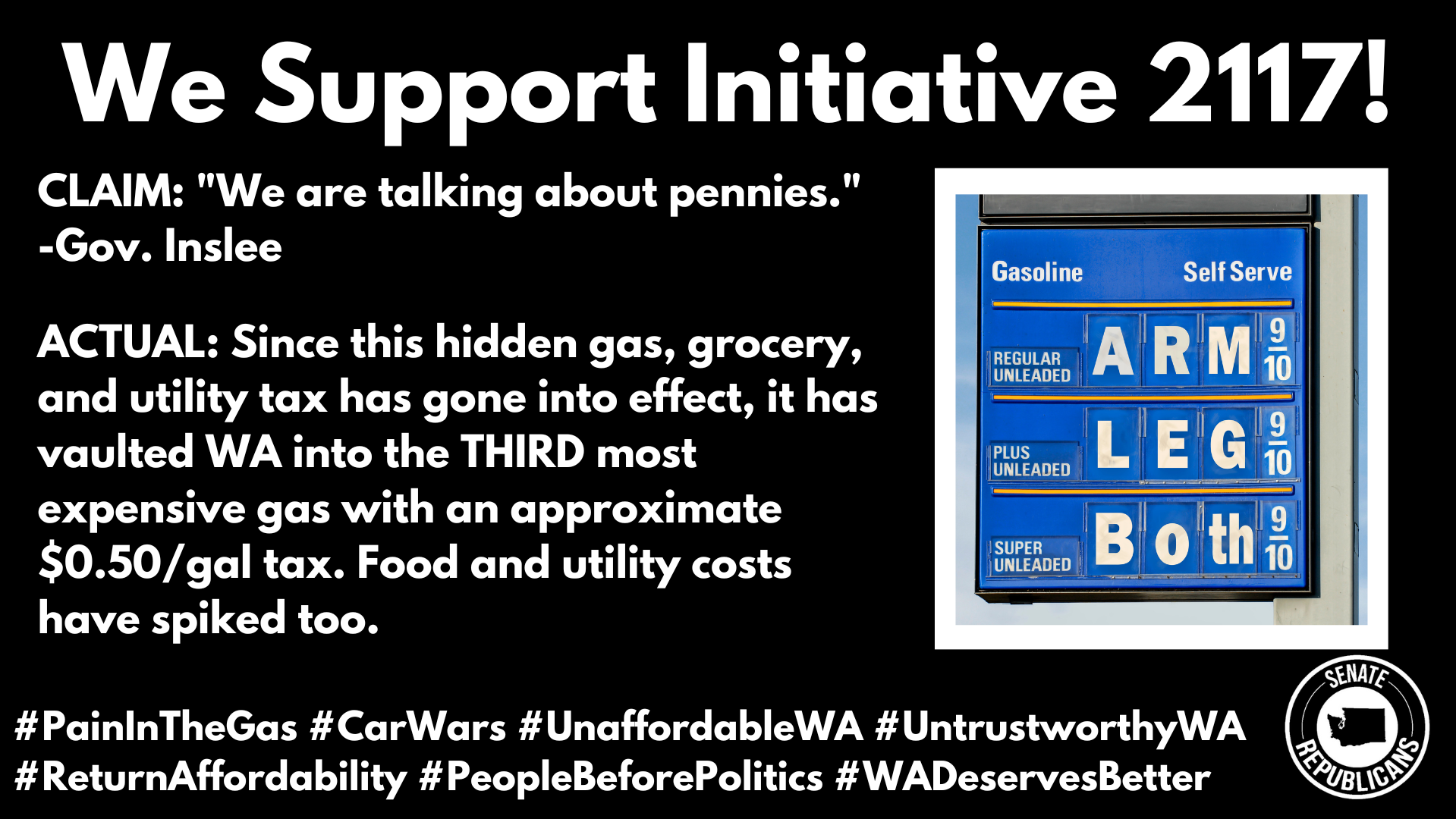

Senate Republicans also call it a “hidden gas tax” because so much of it rides on the backs of anyone who buys gasoline. That means pretty much all of us, including those with lower incomes barely making ends meet.

Once this initiative was certified, the Legislature should have fulfilled its constitutional duty and given this measure its highest priority, over and above everything except appropriations bills. We believe the full Legislature should have been allowed to vote on it. We say the Legislature should have passed it.

Background

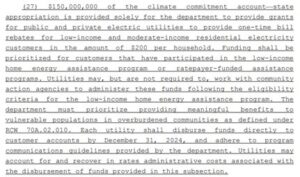

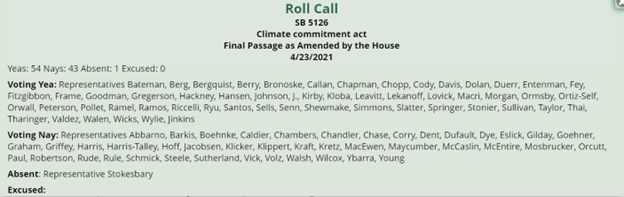

The so-called “Climate Commitment Act,” passed in 2021, taxes Washington consumers and industries to pay for government programs that supposedly reduce greenhouse gases. It requires industries that emit carbon to purchase “credits” under an auction system managed by the state.

As of January 2024, this program amounted to a $1.8 BILLION hit to our economy and the people of our state.

Since it the Legislature passed the CCA and its cap-and-tax program, drivers around Washington have been forced to pay much more for gasoline than in nearly every other state except California and Hawaii.

According to AAA’s state-by-state gas price averages, Washington’s average gas price as of January 16, 2024, was $4.01 a gallon. At that time, only three states had gas above $4/gallon – Washington, Hawaii, and the most expensive — California.

Meanwhile, 47 states and the District of Columbia had average gas prices below $4. The national average was $3.07/gal. Washington’s gas was $0.94/gal more than the national average. The lowest price was $2.56/gal in Oklahoma. Washington’s price was $1.45/gal, which was more than that in Oklahoma.

Besides being two of the only two states with the highest gas prices, Washington and California also are the only two states with “cap-and-trade” programs, and the other high-cost state – Hawaii – is in the middle of the Pacific Ocean – 2,000 miles from the U.S. mainland.

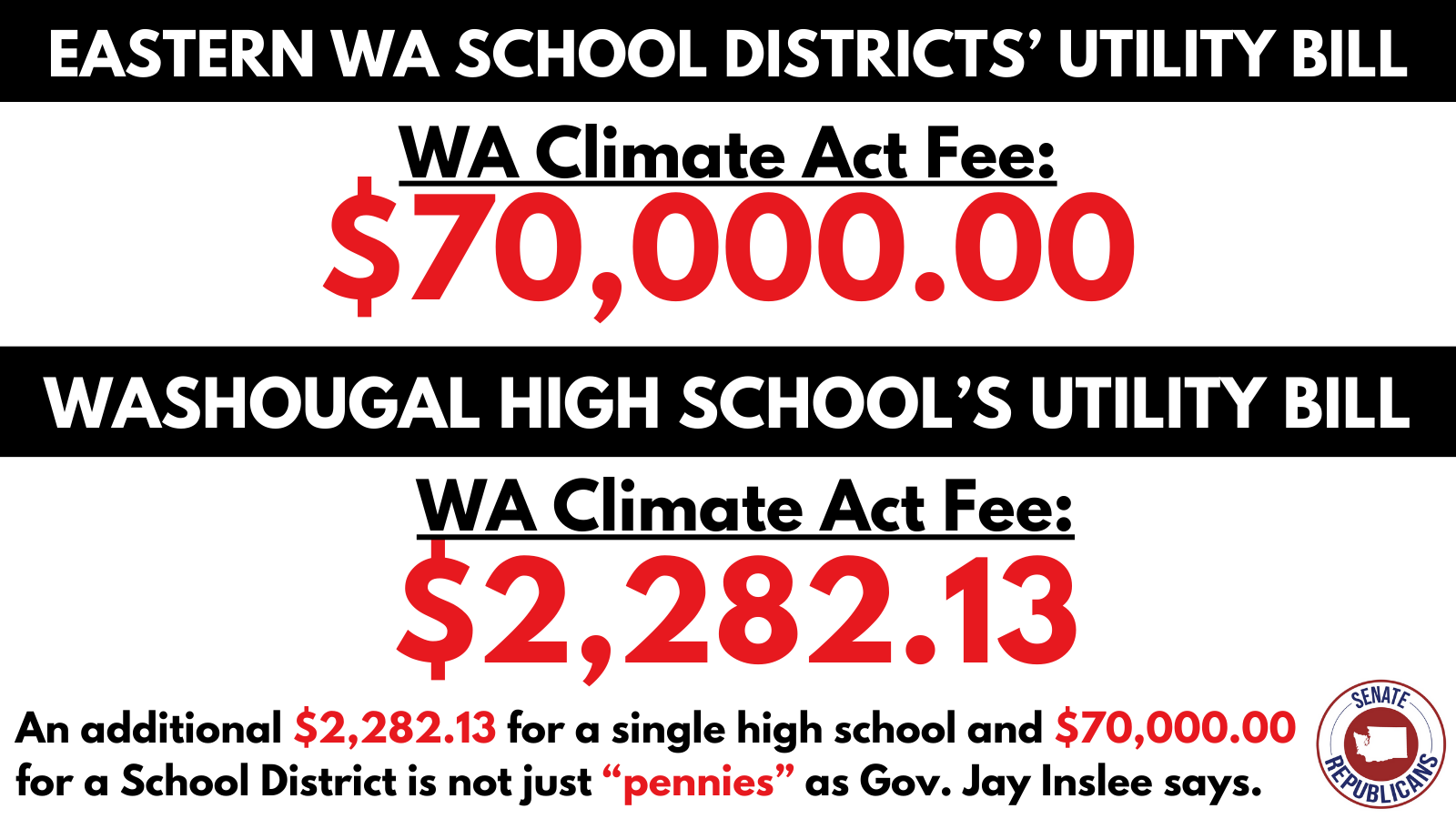

Governor Jay Inslee – who said “cap-and-trade” would raise gas prices by only “pennies…if any” — and legislative Democrats have done nothing to reduce the higher gas prices. While the governor made his claim that “cap-and-trade” would, at most, cost pennies, his chief policy advisor told members of the Senate Environment, Energy & Technology Committee that a “High Carbon Price” scenario with a CO2 price of $52 per metric ton would increase gas prices by 44 cents per gallon.

His office knew all along the impact would be in line with what Republicans, the Washington Policy Center, and an economist at the Department of Transportation projected.

Low-income people have been hit especially hard since they typically must devote a larger portion of their income toward gas and transportation because of where they live, especially in rural areas.

Higher gas prices were just the beginning. This program is driving up the cost of EVERYTHING that we buy in a store or have delivered to us. Cap-and-tax is one of the big reasons the cost of living in Washington is skyrocketing.

For what? This program won’t do anything to affect worldwide climate change. Washington produces two-tenths of one percent of world greenhouse gases. Anything we do here is wiped out by emissions increases in China, India and the Third World.

We have no problem with the idea of transitioning to cleaner energy sources, but this is something that should occur naturally, over time, driven by market forces and the advance of technology. The CCA goes about it the wrong way.

Why is this initiative needed?

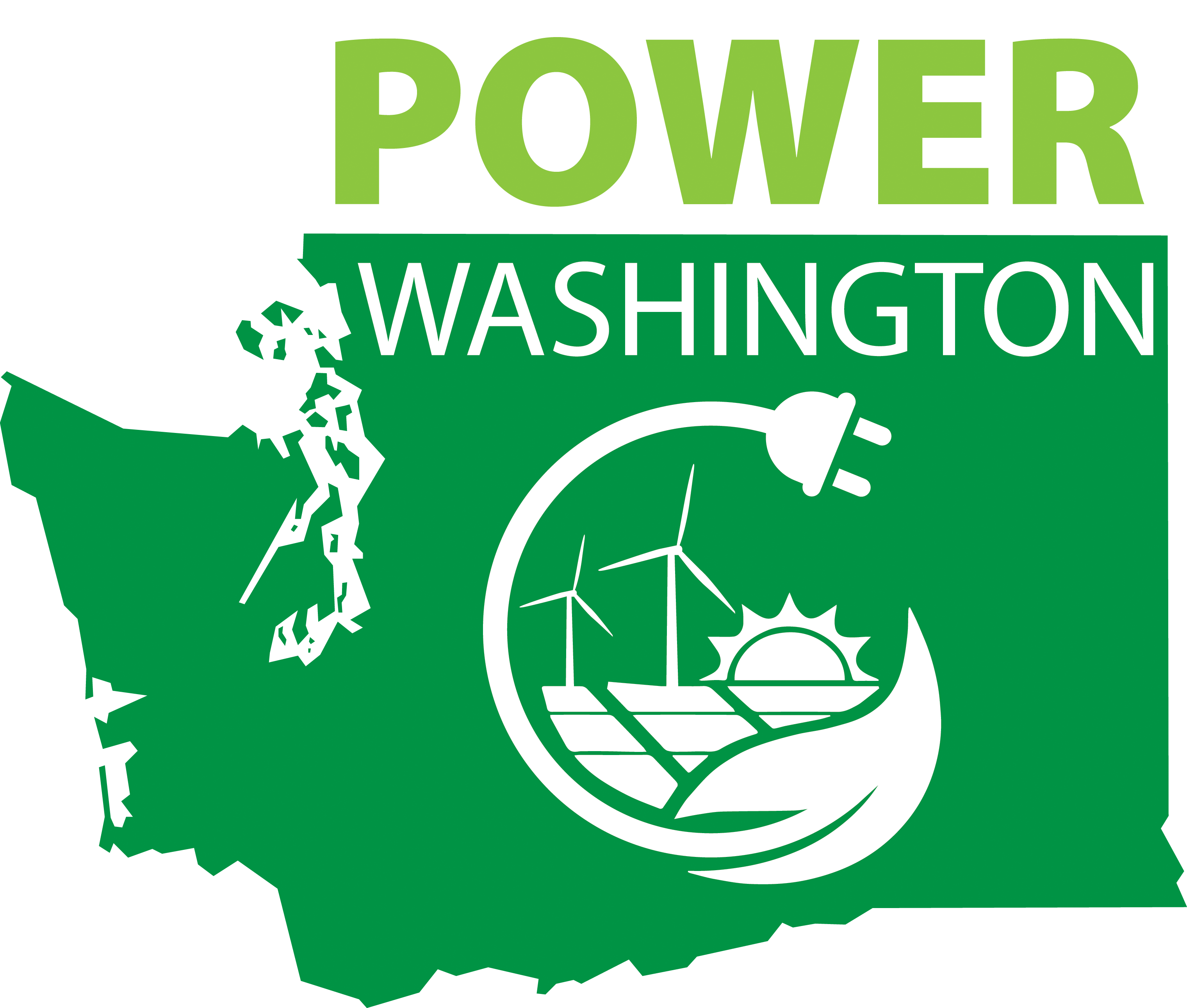

Initiative 2117 – Repealing the Democrats’ cap-and-tax legislation was necessitated by the overwhelming Democrat vote for Senate Bill 5126 in 2021 which was signed into law by Gov. Jay Inslee. Although Gov. Inslee and other Democrats claimed the bill would only raise the price on gas by “pennies,” it actually raised the price on gas nearly 50 cents/gallon — even more on diesel. It also caused the price of home and business heating to skyrocket. I-2117 will repeal this hidden gas tax. Of the almost $2 Billion it has removed from the pockets of Washington citizens, not a single dime goes to build or repair failing roads and bridges.

2021 HB 5126 – Concerning the Washington climate commitment act

Chamber: SENATE 2021 Regular Session

Bill No: E2SSB 5126 Docs

Motion: FINAL PASSAGE AS AMENDED BY THE HOUSE

Item No: 10

Transcript No: 104

Date: 04-24-2021

Yeas: 27 Nays: 22 Absent: 0 Excused: 0

| Voting yea: | Senators Billig, Carlyle, Cleveland, Conway, Darneille, Das, Dhingra, Frockt, Hasegawa, Hobbs, Hunt, Keiser, Kuderer, Liias, Mullet, Nguyen, Nobles, Pedersen, Randall, Robinson, Rolfes, Saldaña, Salomon, Sheldon, Stanford, Wellman, Wilson, C. |

| Voting nay: | Senators Braun, Brown, Dozier, Ericksen, Fortunato, Gildon, Hawkins, Holy, Honeyford, King, Lovelett, McCune, Muzzall, Padden, Rivers, Schoesler, Short, Van De Wege, Wagoner, Warnick, Wilson, J., Wilson, L. |

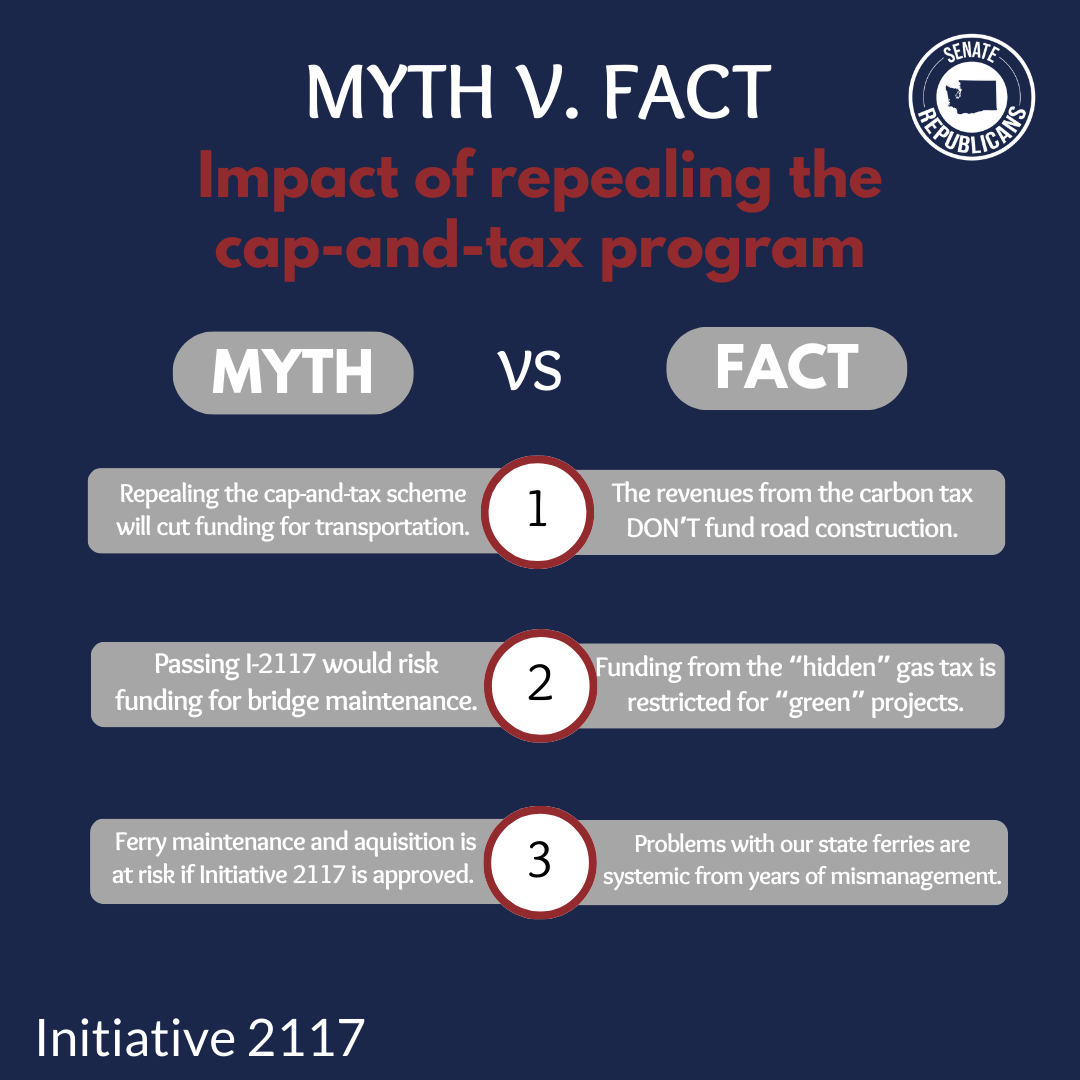

No, the sky will not fall

- Democrats claim repealing the “Climate Commitment Act” would blow a $1 billion hole in the transportation budget. A repeal of the “CCA” impacts future spending, so there is “no hole” in the actual budget.

- Only 7% of the state’s $13.5 billion transportation budget comes from cap-and-tax revenues. Of the $969.894 million coming from cap-and-tax, no funds are used for 18th amendment road or street projects.

- The “Climate Commitment Act” forbids the use of funding from the cap-and-tax program for roads and bridges.

- Move Ahead Washington is expected to spend $5.4 billion of CCA money over 16 years on transportation items that are not highway related. This amounts to $337.5 million annually in a budget of over $10 billion every two years.

- Transit agencies are independent taxing authorities, so the state’s funding is supplementary to their operations budget.

- The biggest deception is the claim that this will greatly impact climate change. The governor and other advocates keep linking Cap-and-Tax to improving snow packs in the Cascades, stopping forest fires, and reducing ocean temperatures. They don’t quantify these empty claims because they can’t. Our world ecosystem does not depend on the policies adopted by the Washington State Legislature.

- Cap-and-Tax is the worst kind of “virtue signaling.” It imposes high costs on the state and burdens our most vulnerable citizens for very little benefit. About 420,000 people have spoken by signing petitions to put this issue before the Legislature. We should listen to them, do our duty, prioritize this, and pass this legislation.

The Legislature has a spending problem, not a revenue problem

Washington Policy Center says…

|

|

|

Problems from the beginning

Where is the exemption for the agriculture, maritime, and aviation industries?

- The state’s cap-and-trade program was supposed to provide an exemption for agriculture, commercial fishing, and aviation from paying the fuel surcharge created by the program. But those industries have not received that exemption.

- Several Republican legislators have asked the state Department of Ecology to make sure this exemption becomes a reality for farmers and the others who should receive it. However, DOE has not honored this section of the new law. Instead, DOE officials have pointed fingers at oil companies, saying they were causing the problem – the same thing Governor Inslee has done when asked about high gas prices.

- DOE convened a work group in the summer of 2023 comprising more than 30 farmers, fuel distributors, climate advocates and others to resolve the cap-and-trade exemption problem for farmers. But these so-called solutions offered by this work group are not perfect.

- A news story reported that one of the biggest obstacles for the work group has been figuring out how to track and exempt fuel used exclusively for agricultural purposes purchased at retail gas stations. Farmers and truckers who fill up vehicles at roadside gas stations say they cannot get exempted.

State leaders tried to hide the cost of cap-and-tax

- Gov. Jay Inslee and other state leaders have not been entirely honest about the impact the cap-and-tax program would have on the price of gas and home heating fuel.

- Republicans predicted a 45-50 cent-per-gallon increase to gasoline, which turned out to be accurate. However, the governor claimed we were fear-mongering and went on to say that the program would cost people “pennies” and might even lower gas prices.

- The governor also blamed gas station owners and oil companies for unnecessarily raising the price of gas. Hypocritically calling for “radical transparency,” the governor called for legislation to force the oil companies to open their books to state review. A Democrat bill sponsored this year to require them to do so died, which means it didn’t even have enough support among Democrats to pass.

- The Attorney General’s office advised the Utility and Transportation Commission to rule that a local power company could not include the impact of the cap-and-tax program to people’s power bills on their statements.

- Eventually, it was discovered the governor’s office knew of the true impact of the policy all along, although the governor continued to blame others by saying his incorrect figures came from the Department of Ecology.

- The Department of Transportation is now accused of pushing one of their economists out of his job because he predicted the same price impact we did and he was told to change his numbers. He would not do so and is now suing the DOT.

Built on falsehoods

- A falsehood being used to scare people about I-2117 is that major transportation projects would be cancelled if cap-and-tax is repealed. Advocates falsely claim there will be no more roads or ferries, and that our children will suffer from poor air quality.

- Only 7% of the state’s $13.5 billion transportation budget comes from cap-and-tax revenues. Of the $969.894 million coming from the CCA, no funds are used for 18th Amendment road or street projects.

- The biggest deception of all is the claim this will have a large impact on climate change.

- The governor and other advocates keep trying to link cap-and-tax to improving snowpacks in the Cascades, stopping forest fires, and reducing ocean temperatures. They don’t quantify these empty claims because they can’t.

- Cap-and-tax is the worst kind of “virtue signaling.” It imposes high costs on the state and burdens our most vulnerable citizens for very little benefit.

- About 420,000 people have spoken by signing petitions to put this issue before the Legislature. We should listen to them, do our duty, give this a high priority, and pass this legislation.

Call to conserve power proves need for better energy policies

By Sen. John Braun

Millions of power customers in Washington received a notice during a recent cold snap to lower their thermostats and limit their use of hot water to alleviate pressure on the power grid while Washington experienced winter weather.

These alerts should serve as a reminder that public policy matters when it comes to our state’s energy system. Unfortunately, for too long, legislative Democrats and the gover nor have been carrying out an energy agenda that threatens to push the Northwest’s power grid to a breaking point. Instead, we should be looking to create a more resilient grid with a diverse set of energy resources.

nor have been carrying out an energy agenda that threatens to push the Northwest’s power grid to a breaking point. Instead, we should be looking to create a more resilient grid with a diverse set of energy resources.

If the grid can’t handle current demand during a brief cold snap, it won’t be able to handle the increased demand that will come from millions of additional electric vehicles on the road. Combine that with proposals to ban natural gas and breach the Snake River dams and you have a catastrophe in the making. If the grid fails, millions of people would be put at risk – left without a dependable way to heat their homes. People living in houses with wells could lose access to water. Those with plug-in electric vehicles may be stranded.

The better approach is to responsibly build and strengthen our power infrastructure. Senate Republicans have proposed a plan called ‘Power Washington,’ which is made up of pragmatic and equitable solutions that would make a real difference. This is a complicated issue and simply banning fossil fuels and taxing an overworked grid is not the way to keep people safe and warm. It may sound good in theory to some, but it’s not a real-world solution.

Attorney General’s office tells PSE to hide “cap-and-tax” impact

By Sen. John Braun

The commissioners at the Washington Utilities and Transportation Commission (UTC) ruled that it is illegal for PSE to disclose that information to you as a stipulation for approving a 3.25% increase to your bill to cover $16.8 million in losses PSE expects as a result of that program.

Todd Myers of the Washington Policy Center sums up the ruling as one of the “most brazenly dishonest rulings” he’s ever seen. In it, he says the UTC:

- Admits the new CO2 tax increases energy prices

- Contradicts another one of the false claims by Gov. Inslee and the Department of Ecology

- Brazenly tries to hide those very facts from the public

Worse is that the office of Attorney General Bob Ferguson says including that detail would “unnecessarily complicate” your statement and that your bill should only share information that is “beneficial” to you.

“…this is not only dishonest but violates the spirit of Washington’s laws and constitution. The position of the Public Counsel in the Attorney General’s office is that they know what the public should know and what they shouldn’t. The claim that transparency is bad for the public is remarkable and revealing.”

Todd Myers, Washington Policy Center

This is lying by omission. By not being transparent about why your power bill is going up, the government dodges any accountability for it.

Their excuse — that full disclosure makes the bill too complicated for you — treats you like you aren’t smart enough to understand it. In reality, they fear that you are too smart not to realize they are at fault for another increase to your cost of living.

The sad irony is that the Department of Ecology claimed that the cap-and-tax program would decrease the cost of energy.

And, in the regulatory proceeding with the UTC, left-wing environmental activist groups who previously released statements blaming oil companies for price increases told a different tale. They admitted the cap-and-tax program, which is part of the Climate Commitment Act, is the cause. Were they lying then? Or are they lying now?

Watch

Sen. Drew MacEwen, ranking Republican on the Senate Environment, Energy & Technology Committee, discusses the Climate Commitment Act and the cap-and-tax program with the chair of the committee.

Republican Solutions

In The News

Excerpt:

Former WSDOT economist files claim against state over forecasted gas prices

Wash. — A former economist for the Washington State Department of Transportation (WSDOT) claimed he was told to falsify numbers concerning the impacts of Washington’s Climate Commitment Act on gas prices.

Scott Smith, a former transportation planner, filed a complaint Thursday against WSDOT, the Office of Financial Management (OFM) and the governor’s office. In it, Smith claimed that he was the primary employee tasked with preparing a gas revenue and price forecast at the beginning of 2023 for WSDOT’s revenue forecast council.

Smith calculated that Washington’s cap-and-invest program — which went into effect on Jan. 1 — would lead to a 45- to 50-cent increase on every gallon of gas. But, Smith said his supervisors at WSDOT instructed him to keep that information quiet, per direction from the Office of Financial Management.