An Affordable Washington

2025 Legislative Session

Republican

Wins

The Budgets

Operating

- $77.9 billion, reflecting 8.2% growth

- $12.5 billion in state and local taxes

- $4.5 billion in new spending

- Largest tax increase by percentage of the budget since the 1981-83 biennium

- Equivalent to a $2,000 annual tax increase on a family of four, by the end of the four years

- 42% of the budget spent on K-12 education – a ratio that’s dropped seven years in a row

Capital

- $7.6 billion

- $975 million for K-12 and early learning

- $781 million for housing

- $1.2 billion for higher education

- $282 for construction of a new Western State Hospital

- $365 million to the Public Works Trust Fund

Transportation

- Maintains and approves state roads, bridges, ferries and transit systems

- $903.4 million on highway preservation projects

- $655.95 million on highway maintenance projects

- Provides $15.5 billion in spending authority for 2025-27 for the capital and operating budget expenses

The Taxes

- $1.6 BILLION: Property-tax increase through higher local levies and a return to inequitable funding “McCleary 2.0” (HB 2049)

- $3.9 BILLION: Sales-tax increase that will make food, healthcare, prescription drugs and housing more expensive (SB 5814)

- $5.6 BILLION: Expanded on consumers via a higher business and occupation tax (SB 5815)

- $637 MILLION: Expanded income tax on capital gains and death tax (SB 5813)

- $170 MILLION: New tax on storage units and more (SB 5794)

- $281 MILLION: Tesla Tax – taxes certain manufacturers of EVs (SB 5811)

PLUS…

- 50% increase in the Discover Passes

- 38% increase in hunting & fishing licenses

- 50% increase in liquor licenses

Democrat Taxing Timeline

Housing

How would the session have been different if Republicans had been in the majority?

- A 4-year balanced budget we can afford

- No new or higher taxes

- Fewer regulations that increase the cost of housing

- More options for affordable housing

- More investment in jobs

- Lower prices on goods and services

The Elephant in the Dome Podcast: Post-Session Recap: Taxes, Transparency & Tension in Olympia

Our Budget

- No tax increases: This budget does not rely on a single tax increase to close the deficit. Democrats this year have proposed several property tax increases, wealth tax increases, a can/bottle deposit tax, a vehicle mileage tax, and more.

- No fee increases: This budget does not rely on a single fee increase to close the deficit. Democrats this year have proposed fee increases for state parks, hunting, and fishing.

- Funding at near-record levels: Prudent spending decisions – often simply reverting to 2023 or 2024 spending levels – make unpopular tax hikes unnecessary while providing near-record funding to social services.

VIDEO: Sen. Chris Gildon speech in support of $ave Washington Budget

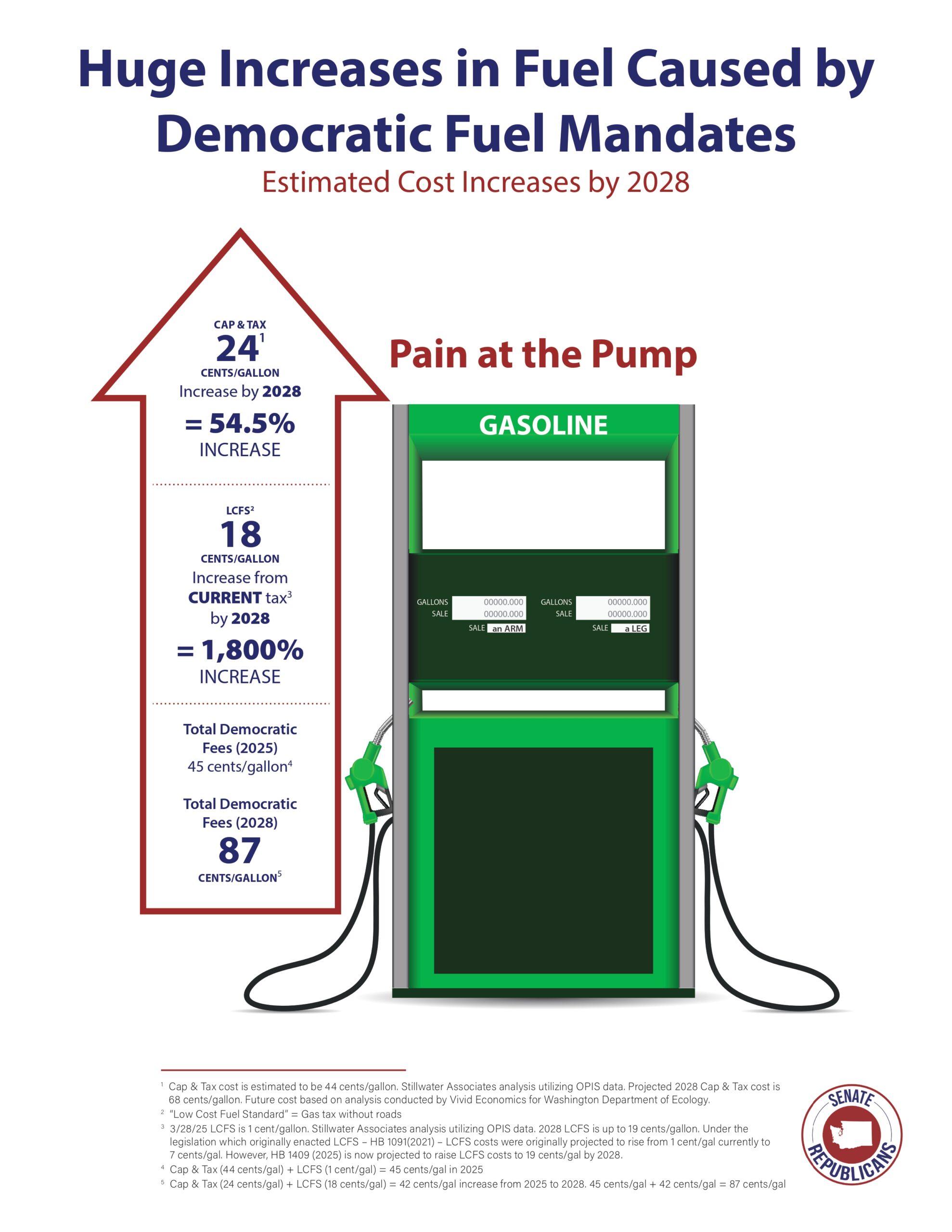

Gas Prices